DIY Book-Keeper versus Accountant In all businesses there comes a point where you need to decide whether you complete the accounting yourself, hire a bookkeeper, or engage an accountant. To help make that decision it’s best to break it down to three key points: Needs – The first point to […]

Category Archives: Blog

GPs need to focus on their future financial planning just like the rest of us. Most GPs we talk to are working long hours in addition to patients with Covid, they are dealing with the fall out of long Covid, mental health issues exacerbated by the pandemic and also those […]

It is no secret that many governments have struggled to tackle the tax challenges that arise from an increasingly globalised and digital economy. However, following years of discussion, on 5 June 2021 G7 agreed to back an historic international agreement on a global tax reform, which will push for […]

Many of us buy clothing that, in reality, we only wear for work – and we are often asked if the cost of these clothes can be set against the tax bill. The short answer is no: HM Revenue & Customs is adamant that such expenditure has a purpose not […]

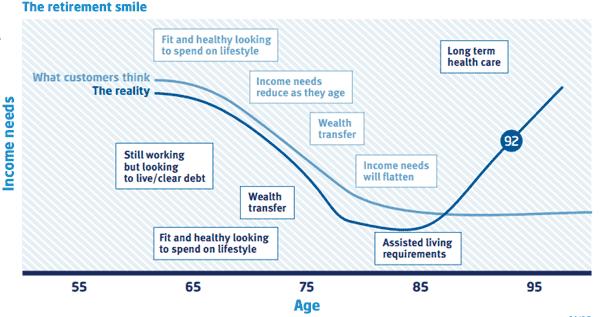

Financial planning – Why it’s better for your money to outlive you? When we put together a financial plan, we use a mortality of age 100 because we don’t want you to run out of money. We also use a financial planning forecasting tool to help you “see” your financial […]

In the 2020/21 tax year, just ended on 5th April 2021, as an employee you may have received extra support from your employer to enable you to continue to work. HMRC introduced a number of concessions so that these necessary support measures are not taxable benefits for employees. They include, […]

To mark World Environment Day (Saturday 5 June) we have been thinking about some small changes business owners can do to have a positive impact on the environment. Below are a few ideas to help your business become more sustainable and do your part in tackling climate change. Save energy […]

A few years’ ago, we felt that it was important to offer our client’s an alternative to our mainstream investment portfolios which are low cost and globally diverse. But what does the green alternative look like? We decided not to call our new portfolios ethical investments. This is because what […]

On 20 May 2021 the Office of Tax Simplification published the second part of its review of Capital Gains Tax (CGT). Whilst most taxpayers encounter income tax, National Insurance Contributions (NICs) and VAT every day, the report is concerned that many taxpayers are strikingly unaware of their obligations to report […]

Not many businesses operate without a bit of bad debt, although hopefully it is just the odd one! However, for tax purposes, there are different rules depending on the tax involved. VAT Relief On Bad Debts There are detailed instructions for VAT relief on bad debts which is set out […]