We’ve produced a handy ‘Top 20 Tips’ guide for SMEs. Focusing on the practical things that businesses need to do, the guide highlights the 3 key areas that businesses need to focus on: their cash, their people and their customers. The guide has been produced following results from our latest […]

Category Archives: Blog

The government has announced a number of changes to the Coronavirus Job Retention Scheme – more commonly referred to as ‘furlough’. These changes start to take effect from tomorrow (Wednesday 1 July). To help SMEs understand the changes and how they apply to them, we have produced a handy […]

Many of our clients are receiving Self Assessment Statements advising them that the payment due on 31 July 2020 does not have to be made by the due date. As a COVID-19 measure, H M Revenue & Customs announced that they will not charge interest and penalties on non-payment of […]

For many of us, the last few months have been about ticking some long-awaited jobs off a list. Even for those still working it’s amazing how much time has been freed up when we haven’t got the usual distractions like a social life for instance. At the start of this […]

Over the last year we have been having more conversations around ESG investing – where fund priorities are based on environmental, social, and governance issues. There has always been a small number of individuals who have specifically mentioned that they wish for a particular area to be excluded from their […]

Former Labour Chancellor Roy Jenkins famously described Inheritance Tax as: “A voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue.” Inheritance Tax is now nearly 35 years old, but the comments made by Jenkins back in the day still hold a kernel of […]

I’ll not to start this with the usual “I hope this finds you well?” as this seems to be at the start of every fund manager communication we’ve had since this crisis began! I do genuinely hope though that you and your family are managing to stay healthy and sane […]

We know how tough the past few weeks have been for SMEs and with an easing of lockdown rules approaching, getting your business ready for operating in a post-lockdown world has its own unique challenges. Businesses now have increased obligations and responsibilities – from ensuring adherence to social distancing measures […]

The number of days spent in the UK is integral to the calculation of your UK tax position and the unusual circumstances of COVID-19 mean that some people may be spending more time in the country than normal. Whilst there is no extension to the number of days you can […]

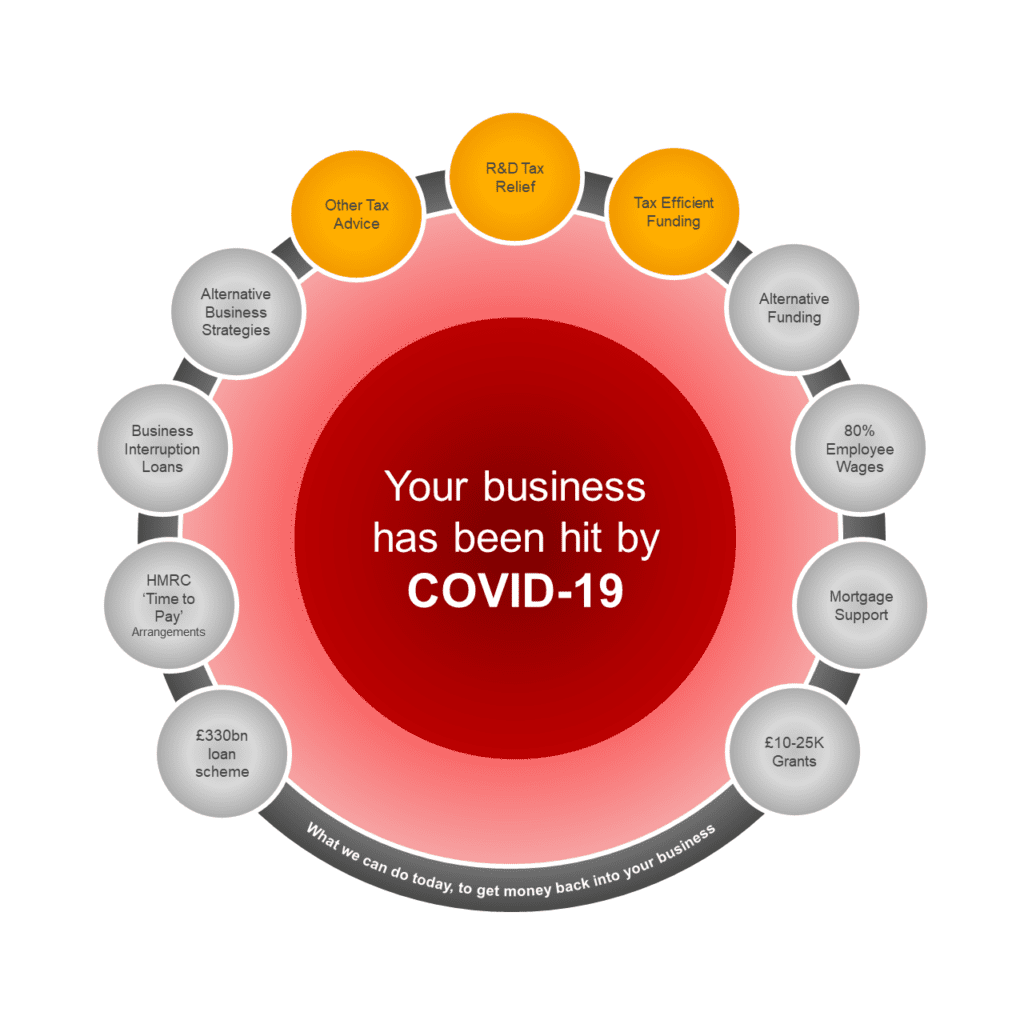

As the pandemic continues to grow in the UK, businesses are currently faced with extremely difficult conditions and for most companies, business as usual is not an option. Due to the rapid spread of the virus and enforced lockdowns, for many, sales are minimal to negligible and businesses are being hit […]