Whether you’re environmentally conscious or just after something practical – the choice of electric car models has skyrocketed over the last year or so. More and more well-known brands have launched their own take on electric cars to try and complete with the market leader – Tesla. Not only is […]

Category Archives: Taxable Benefits

“Should I get a company car?” is probably one of the most asked questions we receive. The fundamental answer revolves around tax efficiency and sustainability. A company car is a way your company can pay you back for your hard work, but you should also consider the purpose and values of […]

The principle behind our Business Accelerator service is the “Now, Where, How” framework, which helps businesses and individuals facilitate growth by working through three questions. This can be universally applied to clients who are eligible for Research and Development claims: Where are we right NOW? WHERE do we want to […]

The 2020 Budget increased the scope for many high earners to make a bigger pension contribution in the tax year ending 5 April 2021. The annual allowance income limit was increased to £200,000, significantly reducing the number of people affected by the tapered annual allowance. The availability of a full […]

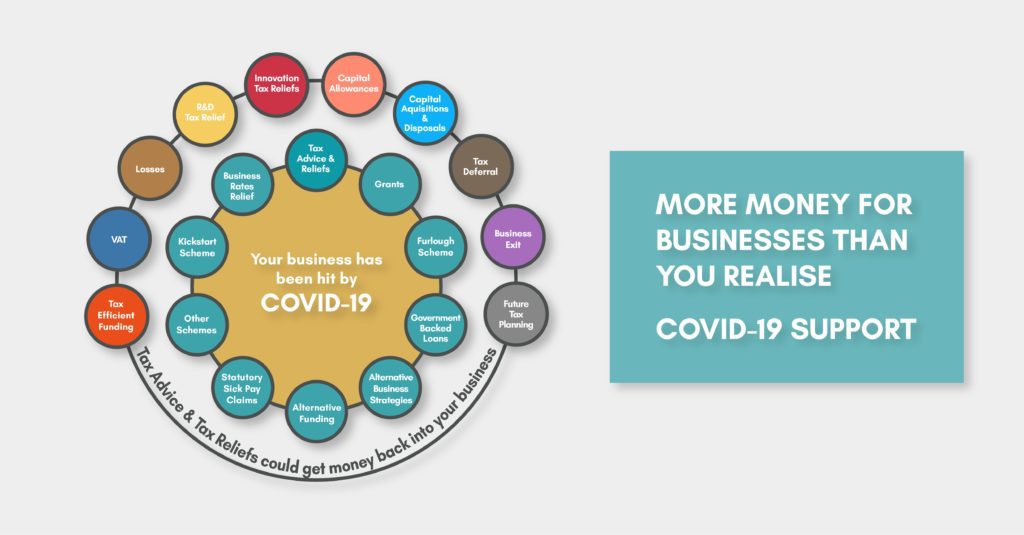

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

For tax professionals, the idea of escaping to some Spanish sun in January is a pipe dream, even in non-Covid times, as we grapple with the personal tax return submission deadline. And with Spain on the brain, we are advising clients to be aware of changes to EU tax […]

HM Revenue & Customs have slightly changed the requirements for claiming the third tranche of the SEISS compared to the previous two tranches – but the result may have a major impact on the self employed’s ability to claim the SEISS. When claiming the first two SEISS grants the […]

The rules regarding UK residency and UK tax position are not straightforward and we recommend that this is carefully reviewed to ensure your peace of mind. As well as the usual regulations, HM Revenue & Customs’ rules include a 60 day “exceptional circumstance” get out clause. However, this may not […]

You may be able to claim tax relief for additional household costs if you have had to work at home on a regular basis, this includes if you have to work from home because of coronavirus (COVID-19), either for all or part of the week. Additional costs include things like heating, metered […]

Today to support Financial Planning Week are some top tips from our paraplanner Danielle Knowles for young families saving for their future whilst looking after their loved ones… I am Danielle, a 37-year-old mum of two to Charlie 5 and Daisy 3. Working in financial services makes you […]