As the owner of an estate agency, your time is one of your most valuable assets. But running a business can feel like you’re constantly trying to beat the clock. When there never feels like enough time in the day, you lose the ability or motivation to do key business tasks like enhancing customer service, investing in getting the right systems and technology in place, or looking for opportunities to expand.

If you want to increase your time management skills and put your hours to more productive tasks, ask yourself the following questions.

1. Are you practising proven time management techniques?

Time management techniques can help you understand not just how to work more efficiently, but which of your tasks throughout the day are your highest priority and which can be delegated and deleted from your mind.

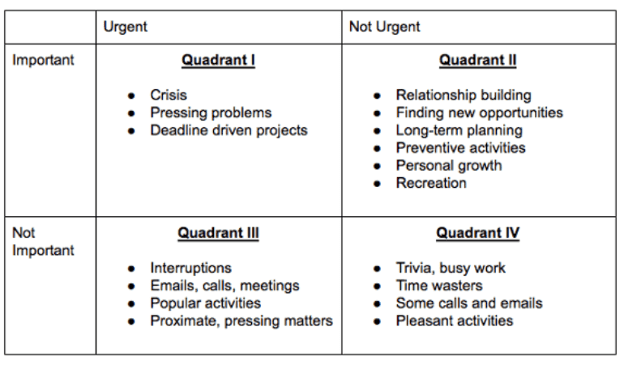

At Robson Laidler, we like to use the Four Quadrants principle. This strategy was created by Steven Coley in his book, “The Seven Habits of Highly Effective People.” The basic idea is to divide all your tasks into four quadrants based on their importance and urgency. It looks something like this:

Depending on in which quadrant each task falls, you can then schedule how much time you’ll commit to each.

- Quadrant 1: Urgent and important tasks are to be completed first. These are the ones that will have the most serious consequences if they’re neglected, like submitting an important form before a deadline.

- Quadrant 2: Important but not urgent tasks are the next priority. These are things that will help you work towards long-term goals, and though they require careful attention they’re not as time sensitive.

- Quadrant 3: Urgent but not important tasks come next. These may seem pressing to you at the time, but consider their overall importance to your business. Can some of these things be delegated to others, or removed from your workflow all together?

- Quadrant 4: Not urgent and not important tasks come last of all. These are the time wasters that add no true value to your day.

2. Are you utilising cloud-based accounting and financial software and apps to help you drive efficiencies?

Cloud-based accounting software is a great timesaving tool that all business owners can use. We recommend Xero because it:

- Allows you to quickly and efficiently complete accounting tasks, like bookkeeping, VAT, or tracking expenses

- Means you can access your key financial numbers from your phone, laptop, or tablet, anywhere and at anytime

- Is linked to your bank account so you get real-time information about your finances

Xero is also fully integrated with great, timesaving apps. Some of our favourites are Dext, Go Cardless, Stripe, Chaser and Square

You won’t believe how much time, stress, and money these apps and softwares can save you until you try them yourself. Your only regret will be not using them from Day 1!

3. Are you wearing too many hats in your business?

The best business owners know how to delegate. But if you haven’t taken the time to clearly outline and define your team’s roles, you may find yourself wearing too many “hats” and losing valuable time that could have been spent on strategic activities.

An Organisational Review involves analysing your business’ functions, employee structure, and processes and finding ways to be more efficient and profitable. Conducting an Organisational Review can give you:

- A functional organisation chart

- Defined departments, functions, roles and responsibilities

- A better understanding of how your processes are impacting your bottom line

We can help you to structure your estate agency so that it’s sustainable, scalable, and saleable.

4. Have you developed a Life Organiser to provide peace of mind and save time in future?

A Life Organiser is a way to securely document and store key information to limit stress and confusion for your loved ones in the event of disability or death. It covers a range of areas, from personal, financial, property, insurance, and business details.

5. Could you outsource?

The quickest way to free up your time with the benefit of receiving expert advice is hiring an outsourced Finance Director for your estate agency. This is the perfect solution if you’ve found yourself trapped in day-to-day financial decisions. An outsourced Finance Director can provide guidance, advice, planning, forecasting and accountability.

An outsourced FD is also a great way to save money. You benefit from onsite industry expertise without having to commit to a salary. Whether you’re growing too fast or not growing fast enough, a virtual FD service manages your finances and buys you the time you need to concentrate on what you do best – leading your business.

At Robson Laidler, we specialise in helping estate agency owners understand what’s happening in their business and find opportunities to grow. We can help you figure out:

- What’s taking up the most time in your agency

- Your relationship with your current advisors

- What the current pain points within your agency are

- What your long term vision looks like

- What information you value

Whether your ambitions are to expand to new locations, increase profits, or make better investment decisions, visit our Estate Agencies page and learn how Robson Laidler can start saving you time today.