There has been a lot of chatter on Robson Laidler’s website and social media regarding R&D and the changes that have recently taken place. Whilst these changes have been notable, they are not exactly radical to the point where you need to rethink your entire R&D strategy. However, the additional […]

Tag Archives: R&D

The landscape of Research and Development tax incentives has changed significantly over recent times, with HMRC recommitting itself to reducing the loss in tax revenues due to fraudulent or erroneous claims (currently estimated at around £311m per year by the National Audit Office). HMRC has already taken steps to reduce […]

The principle behind our Business Accelerator service is the “Now, Where, How” framework, which helps businesses and individuals facilitate growth by working through three questions. This can be universally applied to clients who are eligible for Research and Development claims: Where are we right NOW? WHERE do we want to […]

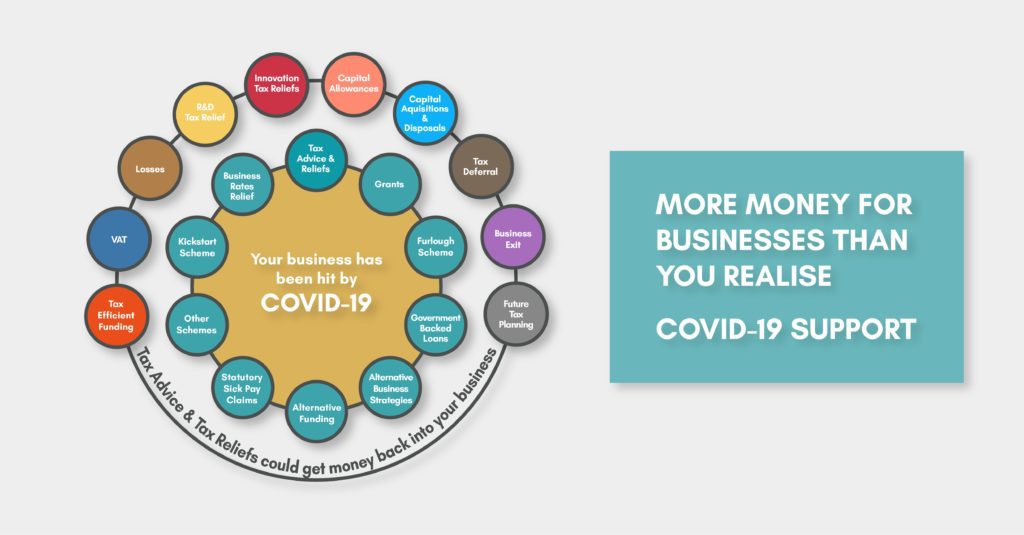

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

R&D tax relief for SMEs is so generous that it is considered to be a Notified State Aid by the European Commission. The problem is that much of the financial support brought in by the Government for businesses during the Coronavirus pandemic is also considered to be Notified State […]

Alongside the schemes HMRC have released for both businesses and the self-employed there is some R&D guidance in response to the COVID-19 pandemic, the headlines of which are: HMRC are aiming to maintain the 28-day turnaround of SME claims for payable tax credits This suggests that HMRC are encouraging legitimate […]

ROBSON Laidler has launched a service that has already saved our clients almost £395,000 by realising and reclaiming Research and Development (R&D) tax credits available to them from HMRC. We have established the new R&D tax credits offering to complement our accounting, business advisory and wealth management services, to help […]

INTRODUCTION Brexit has becoming synonymous with the word uncertainty. Indeed, the events of the previous week that have blown the plan to deliver Brexit by the 31 October out of the water have perfectly encapsulated this sentiment. Parliamentary debates about backstops and no deals and everything in-between have left all […]