The dawning of a new tax year commonly sees a flurry of share transfers as business owners seek to ensure their extractions of profits are tax-efficient. However, transfers of shares between family members and employees can hold lots of hidden tax charges. Here are three of the main types […]

Tag Archives: Tax

After the excitement of the Budget and the issue of the Finance Bill, 23rd March was billed as “Tax Day” with the government issuing a raft of consultations and policies. In the end, the day was – correctly – overshadowed by the anniversary of the first Covid-19 lockdown, but as […]

The 2020 Budget increased the scope for many high earners to make a bigger pension contribution in the tax year ending 5 April 2021. The annual allowance income limit was increased to £200,000, significantly reducing the number of people affected by the tapered annual allowance. The availability of a full […]

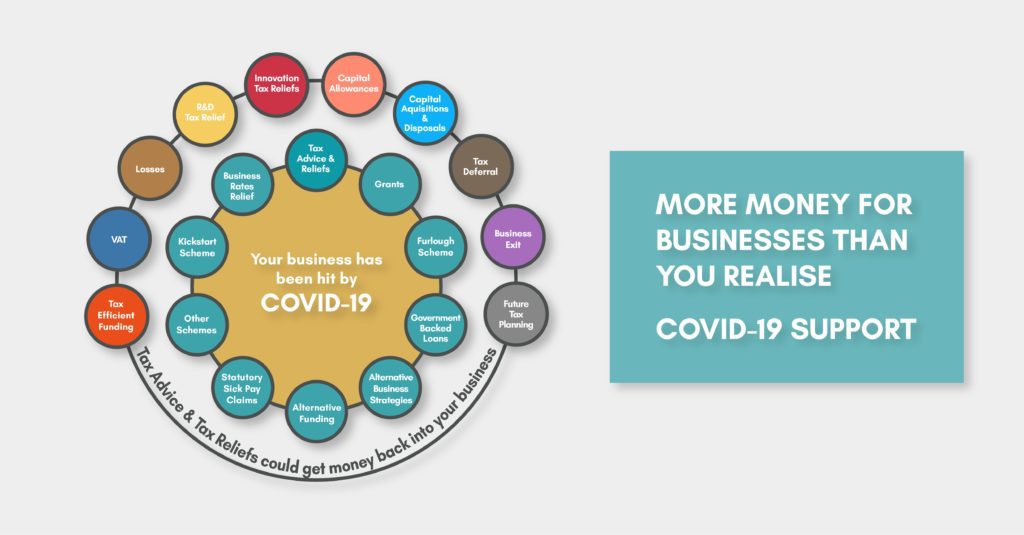

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

Back in July 2015 the then Chancellor, George Osborne, announced a change to the way that tax relief for finance charges, in particular loan and mortgage interest, would be given against residential property rents. Rather than reducing the net profit of the residential property business, any tax due would be […]

Big changes are coming to the way in which VAT is administered to the construction industry. From 1 March 2021 the CIS VAT Domestic Reverse Charge Measure will apply to supplies of construction work. Proposals: When the reverse charge applies the customer must account for the supplier’s output VAT This […]

For tax professionals, the idea of escaping to some Spanish sun in January is a pipe dream, even in non-Covid times, as we grapple with the personal tax return submission deadline. And with Spain on the brain, we are advising clients to be aware of changes to EU tax […]

NHS Pension Members – Don’t forget to declare excesses from your 19/20 pension savings on your January Self Assessment return. If you have exceeded your Annual Allowance for 19/20 and you don’t have sufficient unused annual allowance to carry forward to cover the excess, you must declare this on your […]

If you draw income from your pension or investments ask yourself – do you have a Power of Attorney in place? If you are taking an income from your pensions and investments and these are managed by a financial adviser, then you will likely meet up with your adviser at […]

The rules regarding UK residency and UK tax position are not straightforward and we recommend that this is carefully reviewed to ensure your peace of mind. As well as the usual regulations, HM Revenue & Customs’ rules include a 60 day “exceptional circumstance” get out clause. However, this may not […]