The most basic conditions of the Coronavirus Job Retention Scheme (CJRS) is that your business is / will be adversely affected by Covid-19 and that employees on furlough are not allowed to do any work whilst on furlough. A “snitch line” for false furlough claims has already seen thousands of […]

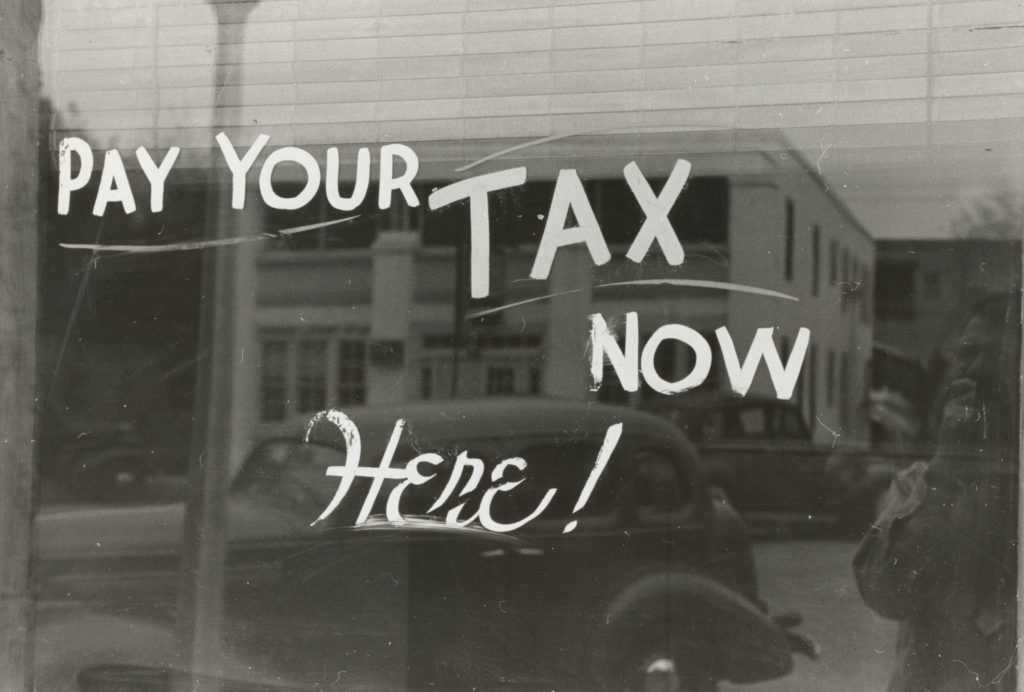

Tag Archives: Tax

If home is where the heart is, homeowners are consistently at the heart of any Budget and last week’s Summer Statement proved no exception. Prior to the Chancellor Rishi Sunak’s announcement last week there were whispers of a Stamp Duty Land Tax (SDLT) slash to be introduced from Autumn […]

Discussing the continuing effects of Covid-19 on the economy Rishi Sunak’s Summer Economic Statement covers several important issues, which are explained in more detail below. COVID-19 has been rife with uncertainty and financial instability for many, and H M Treasury made it clear what it believed the focus of the […]

Many of our clients are receiving Self Assessment Statements advising them that the payment due on 31 July 2020 does not have to be made by the due date. As a COVID-19 measure, H M Revenue & Customs announced that they will not charge interest and penalties on non-payment of […]

Former Labour Chancellor Roy Jenkins famously described Inheritance Tax as: “A voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue.” Inheritance Tax is now nearly 35 years old, but the comments made by Jenkins back in the day still hold a kernel of […]

The number of days spent in the UK is integral to the calculation of your UK tax position and the unusual circumstances of COVID-19 mean that some people may be spending more time in the country than normal. Whilst there is no extension to the number of days you can […]

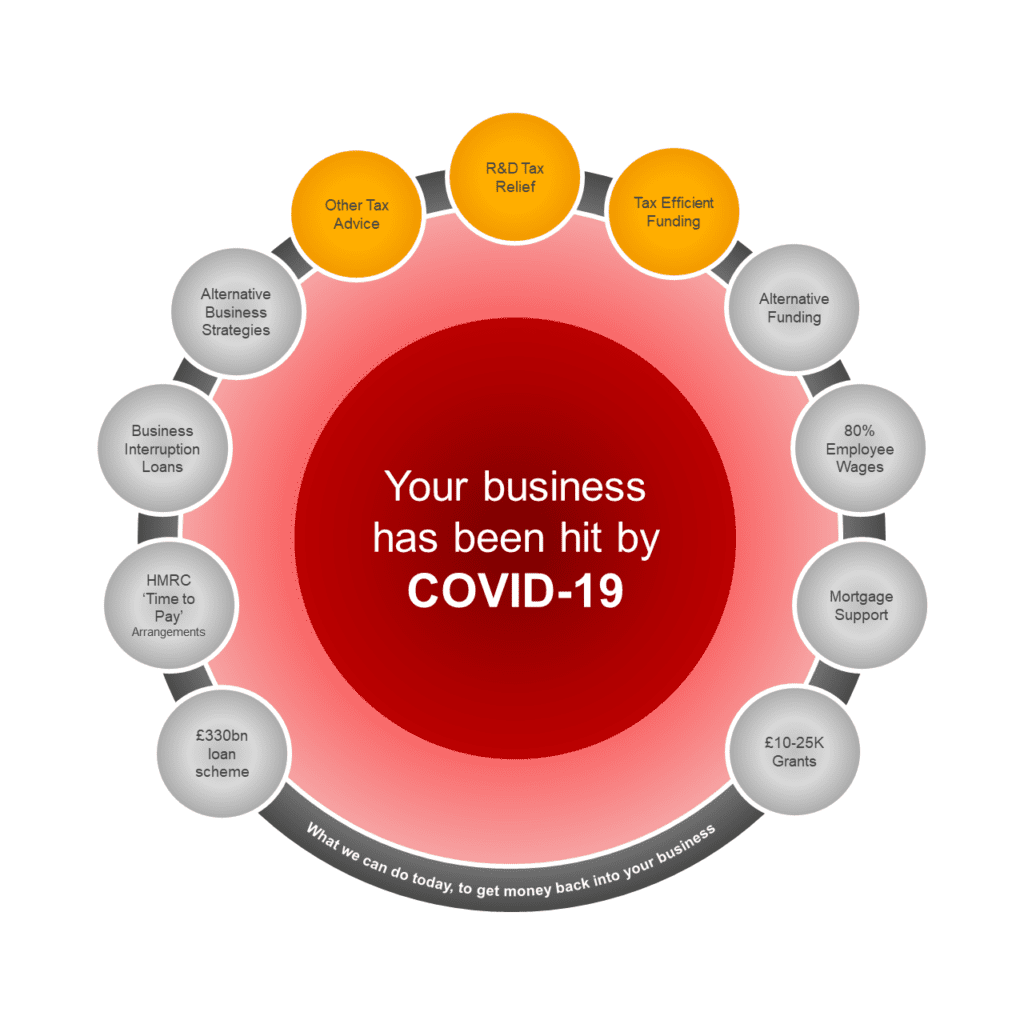

As the pandemic continues to grow in the UK, businesses are currently faced with extremely difficult conditions and for most companies, business as usual is not an option. Due to the rapid spread of the virus and enforced lockdowns, for many, sales are minimal to negligible and businesses are being hit […]

Our tax director Martin Wardle gives his summary of the official guidance that has been released for landlords and tenants as well as a local spin on current matters as a result of Covid-19 from Bruce Haagensen of North East Landlords on it’s effects on licensing and students. Watch our YouTube video […]

Robson Laidler’s annual request for tax return information has now been sent to all our personal tax clients. As ever, our Tax Team requests that you please let us have this information as soon as possible. Tax Manager Lorraine Harnby advises: “The sooner we receive the information, then the sooner […]

Alongside the schemes HMRC have released for both businesses and the self-employed there is some R&D guidance in response to the COVID-19 pandemic, the headlines of which are: HMRC are aiming to maintain the 28-day turnaround of SME claims for payable tax credits This suggests that HMRC are encouraging legitimate […]