To celebrate National Payroll Week, Robson Laidler’s Payroll team are running a series of blog posts to help people understand more about the professional and what’s involved from an employers and employee’s perspective.

It can’t be that complicated, can it?

Just give me your sort code and account number, and were good to go right?

Well, not exactly…

See payroll is more complicated than you might think.

Firstly, it can be easy to get lost in the large quantities of data required for successful administration.

Data your payroll team requires:

- Starter and Leaver forms, including any pay adjustments on leaving, such as final holiday pay due (or owed back to employer).

- Change of Details forms, including amendments to fixed values such as salaries. It is also surprising how many employees only tell you of an address change when they see their old address on their P60.

- Pension scheme adjustments, including Automatic Enrolment opt-out notices and changes to contribution rates.

- Employee Loans, such as new Travel Loans.

- 3rd Party deductions, such as Attachment of Earning notices.

- Variable pay changes for the pay period, including Timesheets, Bonus, Commission, and Expense payments.

This data is needed for the following reasons:

- Without the correct data, the team cannot do their job correctly and you may then receive queries from upset employees who have not been paid correctly.

- Payroll cannot simply set up a new employee to process with only the provision of their forename and salary.

- So that the team can get schemes such as the CJRS claim correct, the introduction of flexible furlough highlighted the need as to why payroll need to know contracted/expected and actual hours worked, and not just a £ wage figure to be paid.

It’s more than the press a button

Payroll departments work to multiple deadlines in a continual time-pressured cycle to ensure your staff are paid correctly, and on time, adding to this all the associated compliance required.

There is very little downtime, if any, as once a pay period has been completed, we must then start on the next pay period – all too true if you have a weekly payroll. There are no seasonal lulls in workload – quite the opposite when having to schedule in the earlier Christmas pay dates and Payroll Year End.

A Typical Cycle Includes:

- Collation and processing of permanent pay data, such as new employees and salary changes.

- Collation and processing of variable pay data, such as timesheets and deductions from pay.

- Calculation and processing of Statutory Payments.

- Obtaining and processing updates from 3rd parties, such a tax code changes, pension changes and Attachment of Earnings / Court Orders and Pension changes.

- Processing, balancing, sense check and peer checking of the payroll data and reports (amend / repeat where necessary).

- Seek internal / client approval of payroll reports (amend / repeat where necessary).

- Create / submit BACS file.

- Issue payslips.

- Issue P45s.

- Submit the FPS (Full Payment Submission) to HM Revenue & Customs (HMRC).

- Issue Automatic Enrolment notices to employees and upload pension files to the pension provider.

- Calculate and pay the PAYE due to HMRC.

- Submit the EPS (Employer Payment Submission) to HMRC.

- Process / post the payroll journal.

- Clear payroll down ready for the next pay period, including the creation of any data templates.

- Deal with any payroll queries that may arise. These could be from your accounts department, employees, and 3rd parties.

- Repeat.

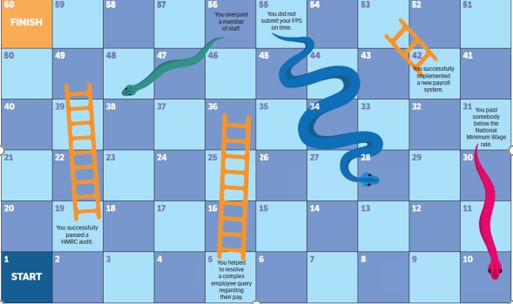

Sounds a bit like a game of Payroll & Ladders!

Robson Laidler understand how integral your employees are to your business and how important it is to get their pay right.

That’s why we endeavour to work closely with our clients to ease the burden of processing the information and payments.

The less time you stress about managing your payroll, the more time you have more time to run and grow your business.

If you have any payroll enquiries and / or would like to speak to us about how we can manage your business’ payroll function get in touch with Robson Laidler’s dedicated payroll team here: payrollteam@robson-laidler.co.uk or contact us through our website.