Stamp duty land tax (SDLT) costs have been reduced following the Government announcement in the Summer Statement. There is a temporary reduction in SDLT rates for residential completions that take place between 8 July 2020 and 31 March 2021, raising the nil rate threshold to £500,000 from £125,000.

The reduction also benefits second home buyers and investment properties who will pay 3% on the first £500,000 of the consideration where the purchase price is at least £40,000.

First-time buyers will only feel the effects where the consideration tops £300,000; prior to 8 July 2020, first-time buyers paid no SDLT on the first £300,000 of the consideration.

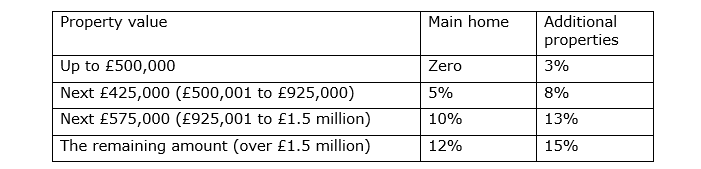

The rates of residential SDLT in England from 8 July 2020 to 31 March 2020 are shown in the table below:

Reductions have also been applied to the residential rates of Land and Buildings Transaction Tax (LBTT) in Scotland and Land Transaction Tax (LTT) in Wales.

The reduction in SDLT only applies to residential properties. The rates for commercial and mixed properties are unchanged. Therefore, it is important to be clear whether a property is residential or not.

Whilst these reductions are in place, it makes sense for completions to happen prior to 1 April 2021.