Are you aware of the temporary increase in the tax allowance available on your plant and machinery expenditure?

With effect from 1 January 2019, the Annual Investment Allowance (AIA) has been increased from £200,000 pa to £1,000,000 pa for a two-year period only. However, if your accounting period extends beyond 1 January 2021 when the AIA reverts back to £200,000, there are complex transitional rules, which mean that the timing of expenditure could have a significant impact on the allowances available.

What is the Annual Investment Allowance (AIA)?

The AIA is a capital allowance that was introduced in 2008 to incentivise investment and boost economic growth. It allows businesses to deduct the entire cost of qualifying capital expenditure from their profits in that accounting period.

It is available for companies, individuals and partnerships and applies to expenditure on most assets purchased including machines, office equipment, furniture, computers and vans.

Without the AIA, qualifying capital expenditure normally attracts tax relief at either 18% or 6% pa on a reducing balance basis.

How does the timing affect the allowances available?

Businesses with accounting periods ending on 31 December need to make sure that they make full use of the £1m available in each of the two years ending 31 December 2021. The timing of expenditure in this situation is straightforward.

However, for those whose year-end straddles 1 January 2021, the rules mean that the careful timing of qualifying expenditure can make a big difference to the tax relief available.

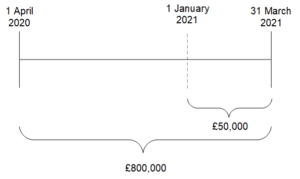

For example, where the accounting year ends on 31 March 2021, AIAs of up to £800,000 would available as shown below based on the annual limits being time-apportioned (9/12 x £1m plus 3/12 x £200,000).

However, the rules stipulate that the AIA available in the notional 3-month period from 1 January to 31 March 2021 must be restricted to £50,000. So, in the example above, if £600,000 was spent before 1 January and £200,000 after, £150,000 of AIA would be lost due to this restriction. This contrasts with the situation where £750,000 was spent before 1 January and £50,000 after where all £800,000 would be eligible for AIAs.

Businesses with large capital expenditure and accounting periods straddling 1 January 2021 will need to plan the timing of their expenditure carefully to ensure that they maximise their available AIA.

The most obvious way of mitigating the risk is for businesses to consider their spending plans and, if necessary, bring forward their capital expenditure to before 1 January 2021 in order to prevent AIA entitlement being wasted.

For further information and advice, please contact our Tax team.