I’ll not to start this with the usual “I hope this finds you well?” as this seems to be at the start of every fund manager communication we’ve had since this crisis began! I do genuinely hope though that you and your family are managing to stay healthy and sane during this lockdown period.

The past 3 months has definitely been a test of resolve in lots of areas. I must admit to feeling a bit rattled after finding nothing to buy in my local supermarket – it’s natural to put your security in your finances, your health and the fact that you can put a meal on the table!

Being a financial planner/wealth manager during probably the worst dip in the stock market since 2008 definitely tests your resolve and belief in the long term plans that you have for yourself and for your clients. When the bulk of your time is spent face to face with clients, a global pandemic presents a bit of a challenge never mind having to test if your business continuity plan works when getting your team set up to work remotely.

- The financial challenge – keep faith in the global markets and your long term objectives

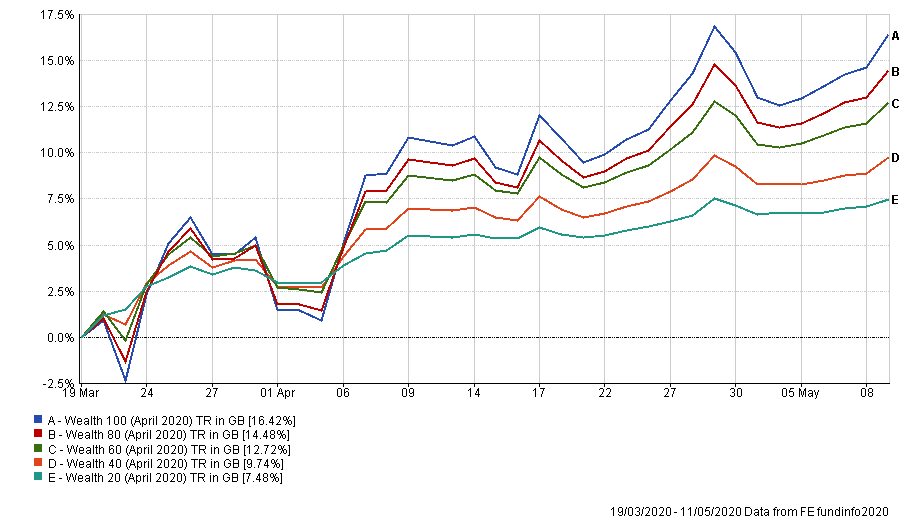

When global stock markets fell sharply in the first 2 weeks of March our advice was to sit tight, remain invested and stick to your long term plan. This does not necessarily feel natural – the usual response for all of us in times of crisis is to “do something”. Thankfully nearly 100% of our clients took this advice and saw a significant recovery following mid March to mid May. Our portfolios did exactly as we would have expected them to. Markets normally fluctuate but occasionally there are shocks – the worst thing to do is to sell when markets have just fallen, then you crystallise a loss and struggle to know when to re-invest. It’s for this reason that we talk to clients about how they feel about taking risk and invest in an appropriate portfolio with equities and bonds.

Past performance is not indicative of future results.

2. The face to face challenge – faith in our client’s ability to embrace technology

We have found that lots of self-confessed “technophobes” have become brilliant at using technology, so we’ve been doing lots of client meetings using Zoom. This has worked well when we are using the financial planning software that we normally show in the office. We do hope though that we will be able to meet up face to face at some point, it is not quite the same!

3. Remote working – faith in our team’s ability to adapt and communicate well

Emma, our Operations Manager, was brilliant at getting everyone set up and testing our “disaster” plan. From the outset we’ve used Microsoft Teams to meet up and discuss what everyone is doing that day. We started using a secure portal this year, so it has really come into its own to enable us to send out documents for e-signing. Again, it’s not the same as working together in one office but it has not impacted the service we provide to clients.

In the words of Robbie Burns, the “best laid schemes o’ mice an’ men gang aft agley”. That’s true, life doesn’t always run smoothly but we remain optimistic that our client’s long-term objectives will continue to be achieved despite this recent crisis.

Get in touch for more info on how we can help you and your long term financial plans.