Over the last year we have been having more conversations around ESG investing – where fund priorities are based on environmental, social, and governance issues.

There has always been a small number of individuals who have specifically mentioned that they wish for a particular area to be excluded from their portfolio, sometimes a specific company. To be honest though, when we have asked the question, not many people have had strong views.

For those who do, we have researched alternatives but always with the caveat that it’s impossible to be 100% “ethical” in their area. Simplistically, if you wish to exclude alcohol and you have a lot of financials in the fund, how do you know that they don’t lend to a supermarket retailer for instance?

There is also the issue that everyone’s idea of what’s “ethical” is different.

We have therefore decided to take a more pragmatic and perhaps positive view. What if we didn’t exclude those we thought were “bad” but actively looked to invest in what was “good”. In an ideal world all companies would prioritise sustainability in terms of the environment, they’d also make sure that all their social policies were equal and fair plus ensuring that they had strong internal controls governing how they run their business well.

Hopefully in the future this will be case, but we are not there yet.

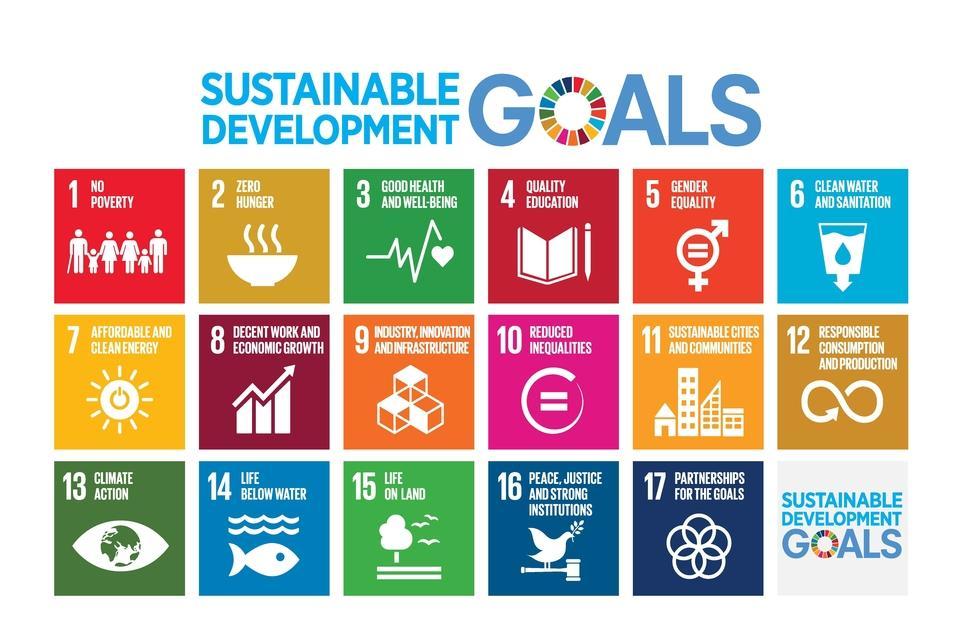

We have therefore researched 5 new risk-based portfolios, which embrace the UN’s Sustainable Development Goals. Our normal criteria for choosing funds remains the same though – they must have a good track record, fund manager charges as low as possible and the overall portfolio to provide appropriate diversification. They will not replace our existing portfolios but provide an alternative.

Past performance is not indicative of future results.

If this is something you’ve been thinking about, please just get in touch.