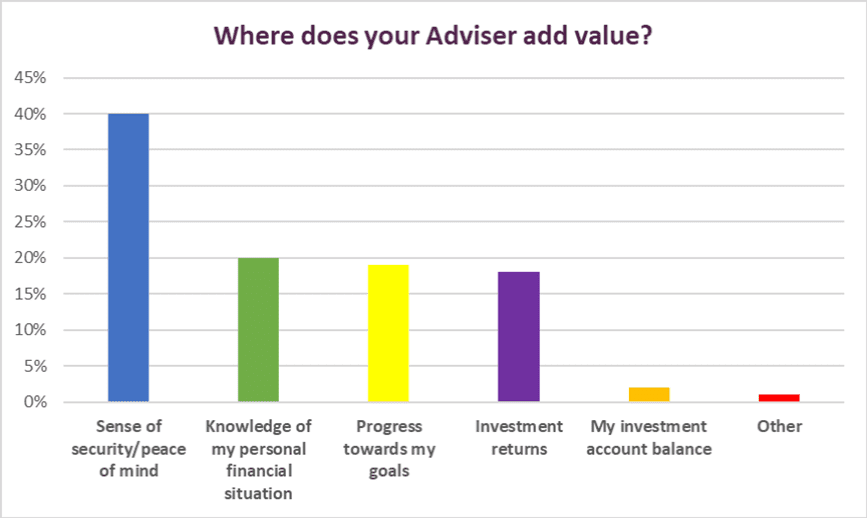

In a recent global study* the question “What do you value in the relationship you have with your financial adviser?”

The results were:

Given what we are going through at the moment you might say that this is pretty obvious. However these results were similar pre-pandemic.

So, how do you know you will be financially ok in the future? Our approach to this is similar to the accelerator’s Now, Where, How model:

- Define what you want. A good place to start, usually a combo of your basic needs and the extras we all like! You can only know this if you “own” what you spend. Be honest – there is absolutely no point in leaving stuff out. We ask clients what they want the financial future to look like. “Are we going business or economy?” Are we eating out once a month or twice a week?” “Are you looking to help your children out?”

- Establish where you are now. Would you have any income if you stopped trading/working? If not then this needs to be addressed now.

- Think about your timescales. Do you ideally want to head for the hills or will you always be involved with your business to some degree. None of us have an expiry date (!) so if you are at the younger age range then your capital will have to work for a longer time period.

- Review regularly. Legislation and tax change all the time and this may require you to tweak your plans.

If there’s a gap between where you are now and where you want to be in the future then it’s time to make an action plan. This is where we come in. Our clients know exactly where they are, where they are heading and how to get there, and we help them save a bit of tax along the way.