Pension Awareness Week is back and this year it’s celebrating 10 years of making a positive difference. Now is the time to get to know your pension better than ever and prepare for the future you want. Our financial planning team Robson Laidler Wealth are on hand to guide and steer […]

Category Archives: Later Life

Something that comes up, a lot! Many of us know of someone in care or needing care and, from our discussions, of course individuals don’t want to see family assets disappear to cover care fees. Conversely though, paying for your own care tends to come with choice. There are […]

High earning NHS workers, including GPs and practice manager partners, could face a £33,000 tax bill due to the way inflation is applied to their pension. The Government has rejected a call from the Association of Independent Specialist Medical Accountants (AISMA) to repeat the 2019/20 compensation scheme, which protected NHS […]

On 29th July 2022, the Financial Conduct Authority (FCA) started regulating the pre-paid funeral plan industry. The regulation is expected to bring higher standards to the industry and boost consumer protection. Up to this date, pre-paid funeral plans were voluntarily regulated by the Funeral Planning Authority (FPA), a self-regulated […]

If you have a UK pension then you may need to be aware of three important changes that were announced in the recent Autumn Budget: No 1. The change to the age that you can take an income from an invested pension. We’ve been mentioning this to our clients […]

Pension Awareness Day takes place annually on September 15 with the aim to alert the nation that they need to save more for their retirement. So what do you need to be aware of exactly? Here’s some tips from Chartered Financial Planner Amanda Cowie director at RL Wealth: Pensions are […]

In these tricky times, how do you as an employer remain profitable whilst trying to look after the wellbeing of your employees? Many employers ask us what an acceptable level of employee benefits is and of course this has to fit within their budget. The pension Since around 2012, […]

GPs need to focus on their future financial planning just like the rest of us. Most GPs we talk to are working long hours in addition to patients with Covid, they are dealing with the fall out of long Covid, mental health issues exacerbated by the pandemic and also those […]

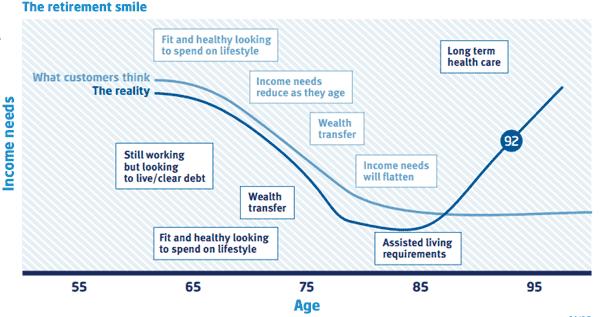

Financial planning – Why it’s better for your money to outlive you? When we put together a financial plan, we use a mortality of age 100 because we don’t want you to run out of money. We also use a financial planning forecasting tool to help you “see” your financial […]

Hurrah, after 5 long years you are now ready to go out and earn some money! What should newly qualified dentists be thinking about? How you are paid Ultimately the contract with the dental practice will determine your status for tax but if you are self-employed, it is up to […]