For many of us, the last few months have been about ticking some long-awaited jobs off a list. Even for those still working it’s amazing how much time has been freed up when we haven’t got the usual distractions like a social life for instance.

At the start of this pandemic, Robson Laidler’s Wills and Probate department saw a deluge of requests from those people who had previously put off/not had time to finalise their will. It’s no surprise that, during a global pandemic, people do start to think, “What if?”

“What if?” is a question we discuss with clients on a regular basis when we are putting together a financial plan. One question might be, “What if I repaid my mortgage instead of investing, how would that compare and impact on my future plans?” Another might be, “What if I bought a second home abroad, how would that impact on my ability to fund my retirement lifestyle?” Fun questions!

Perhaps not so fun is the “What if” around protecting families against the unexpected – premature death or serious illness for example. This is why we have conversations with clients about this at the outset and at different points along the way – circumstances change. It is particularly important when you have a couple with high income who are just starting to build up their capital. Often, they might have high costs too (childcare/school fees/mortgage etc), which are necessary and would not change if say, one of the couple were to die unexpectedly.

We use our planning software to show what level of cover is needed in a “What if” scenario, it’s not about promoting fear but knowing that you have the right amount if the worst were to happen. It’s possible to be insured to the hilt but potentially expensive and not always necessary. You may also have cover from your employer, which should be considered.

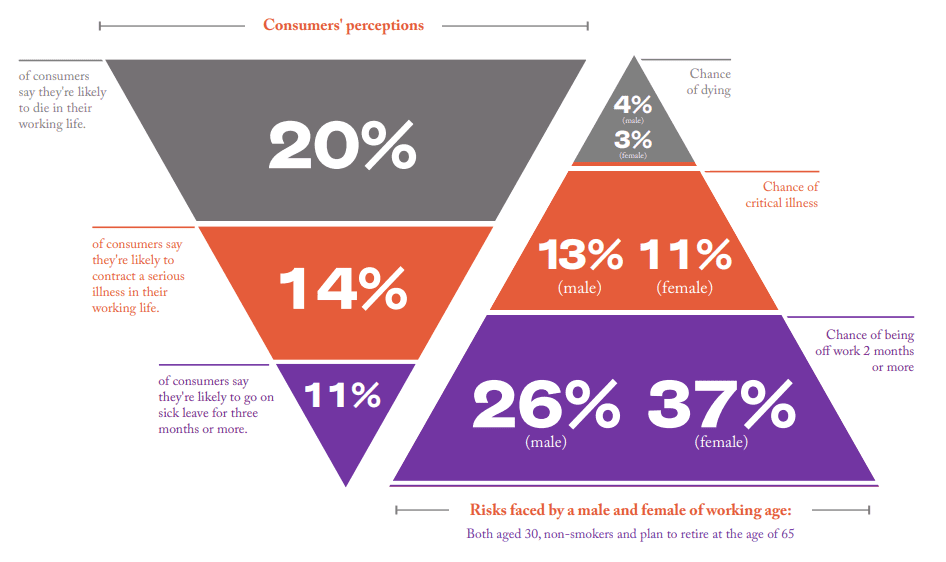

In the UK we tend to insure first against death, next for a critical illness and lastly to protect our income in the event that we are unable to work for health reasons. Royal London conducted a study “State of the Protection Nation” last year and came up with some interesting results:

It’s clear then that the need for income protection is higher, particularly if you are self-employed.

It may be that this unusual time has highlighted the need to have a larger cash reserve and this is something we would always advocate to help provide for needs in the short term. It also might be time to review your existing protection arrangements and this is something we can help you with.