Building a Bigger Business? Start with Strong Financial Strategies! Growing a business is no small feat. Business growth requires dedication, innovation, and strategic financial planning. As business owners, start-ups, directors, and entrepreneurs seek to scale their operations, several pivotal financial areas must be addressed to ensure sustainable growth. As […]

Tag Archives: cashflow

Small businesses tend to be structured in a way that the strategic direction of business is determined by the instincts of the owners. This is fantastic for keeping a business agile but may also lead it into financial difficulty without an independent financial cashflow forecast. Most business owners I […]

When you are running a business it’s easy to confuse cashflow with profit. After all both could be considered to indicate that you’re making money, so what exactly is the difference between the two? Profit Profit looks at the total financial gain (or loss) that a business experiences over a […]

One of the most stress-inducing parts of running a business is not knowing enough about your cash. How much is coming in, how much is going out, where it’s going, whether you’re covered. No fear hits quite like an unexpected bill when you’ve got a bunch of overheads that need […]

As everyone who’s ever started their own business can confirm, cash is king. Without a steady flow of capital into the business, your ability to expand – and even to stay afloat – is likely to be severely compromised. That’s why cash flow management and forecasting play such a vital […]

Rishi Sunak recently introduced a number of new measures of support for SMEs as part of his budget. He also extended some of the existing schemes as well as announcing some new initiatives designed to support the survival, growth and development of businesses. From the extension of furlough to […]

We are deeply concerned about the plight of the smaller businesses across the UK including the c. 3m self-employed directors of limited companies, who are not eligible for the government’s existing grants, and have therefore been excluded from the financial support measures during COVID-19. self-employed director And this is one […]

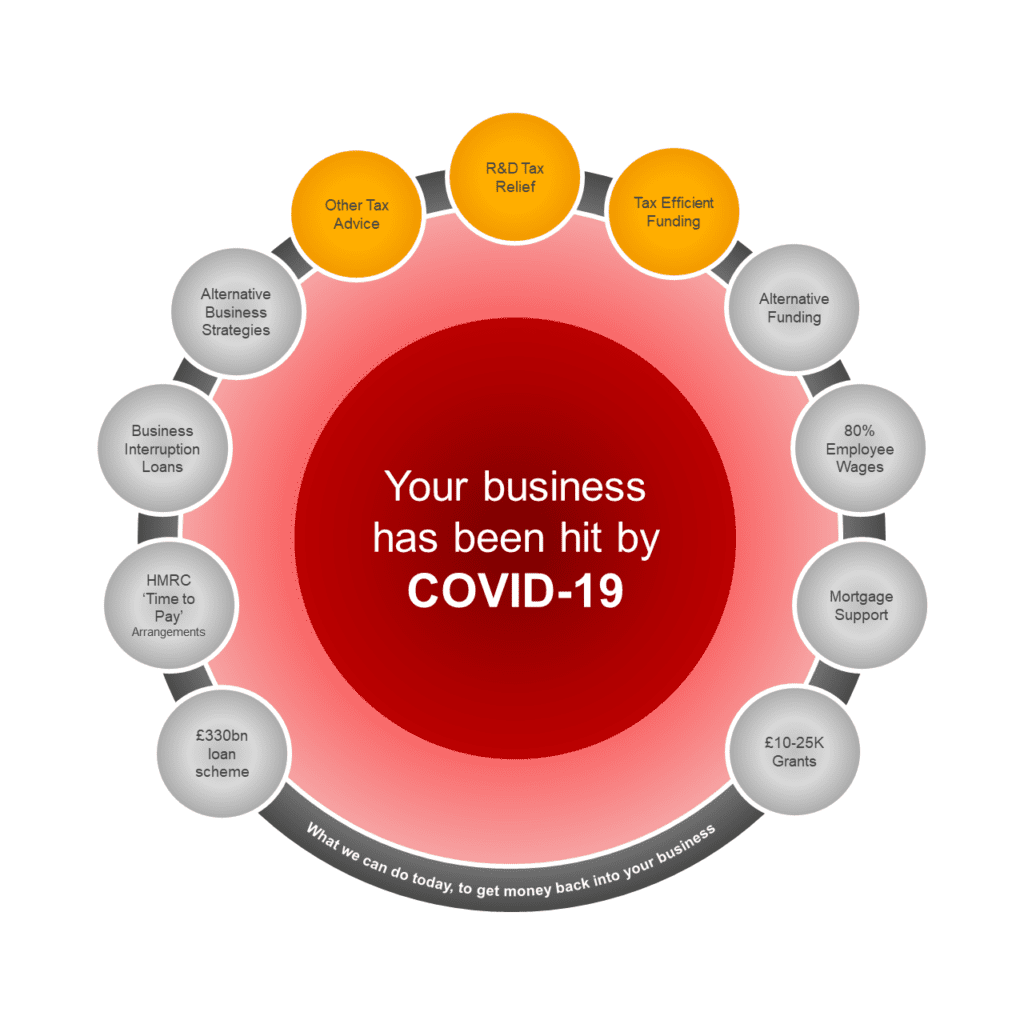

As the pandemic continues to grow in the UK, businesses are currently faced with extremely difficult conditions and for most companies, business as usual is not an option. Due to the rapid spread of the virus and enforced lockdowns, for many, sales are minimal to negligible and businesses are being hit […]

Never has cash flow been more important in a business. Cash flow is the heart of a business, not just profit. If you haven’t got cash it can be a difficult and stressful time. Profit is important too especially if you need to raise finance. Here are some interesting statistics: […]

Our mission at Robson Laidler is to enable individuals and businesses to gain more freedom, through expert advice at every stage of their journey. We therefore aim to help create freedom of time, mind and financial freedom for all of our clients including our healthcare clients. In recent […]

- 1

- 2