Due to increased activity by fraudsters during the pandemic as they attempt to illegally access Covid-19 grants and loans, HMRC has decided to be more wary when submitting tax (including VAT) payments to taxpayers. Accordingly, HMRC is now writing to taxpayers who have claimed a recent tax refund that is […]

Monthly Archives: March 2021

After the excitement of the Budget and the issue of the Finance Bill, 23rd March was billed as “Tax Day” with the government issuing a raft of consultations and policies. In the end, the day was – correctly – overshadowed by the anniversary of the first Covid-19 lockdown, but as […]

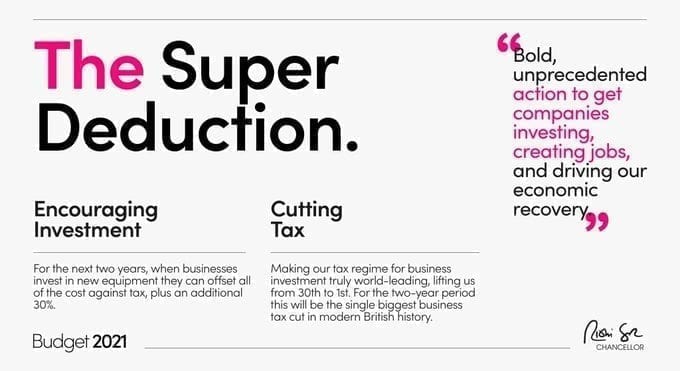

One of the most striking additions to the March 2021’s Budget Announcement was the introduction of a new “Super Deduction” which offers a 130% writing down allowance on qualifying investments. Although this was heralded as the “biggest business tax cut in British history”, do the headlines translate to big tax […]

There is a “movement” doing the rounds at the moment, FIRE, “Financial Independence Retire Early”. It’s based on the bestseller “Playing with FIRE” by Scott Rieckens. Scott was so fed up with his life he decided to quit the rat race, cut his expenses in half so that he could […]

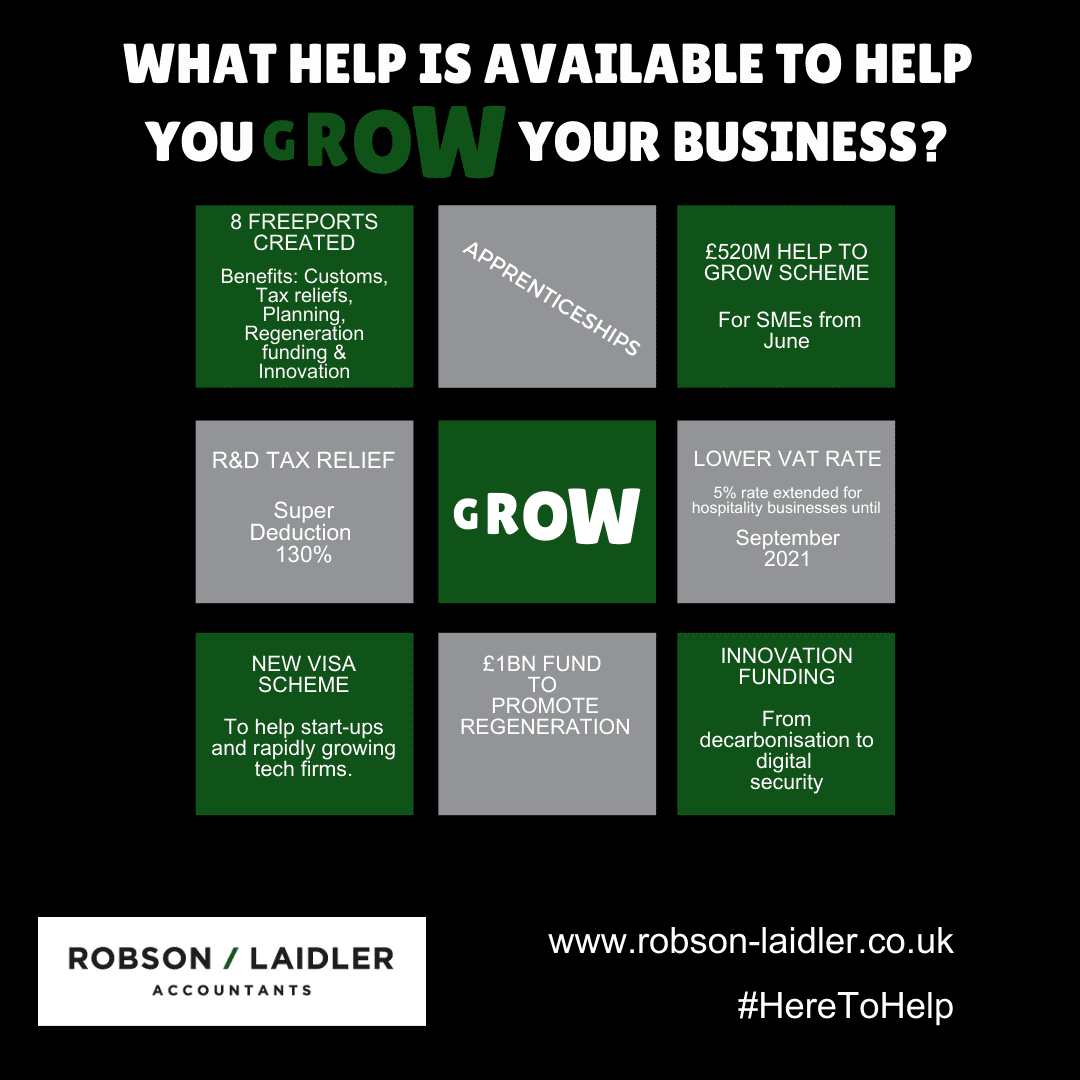

Rishi Sunak recently introduced a number of new measures of support for SMEs as part of his budget. He also extended some of the existing schemes as well as announcing some new initiatives designed to support the survival, growth and development of businesses. From the extension of furlough to […]

HMRC are now asking certain self-employed people to prove that they are still in business before they can claim the next SEISS grant. This is only for those who have indicated that their business ceased trading in the period from 6 April 2018 to 5 April 2020. A pause in […]

The principle behind our Business Accelerator service is the “Now, Where, How” framework, which helps businesses and individuals facilitate growth by working through three questions. This can be universally applied to clients who are eligible for Research and Development claims: Where are we right NOW? WHERE do we want to […]

We’ve reached the anniversary of us all packing up our office and working from home! We cannot believe it’s been a year. It’s certainly had its ups and downs. Recently we read an article in The Times, which covered how six successful women work from home, so we thought we’d […]

We receive a lot of questions along the lines of “how can I plan more efficiently?” or “how can I access my information in real time?” The answers all come back to one key element that not many of us have a lot of – time. Here’s our top three […]

The 2020 Budget increased the scope for many high earners to make a bigger pension contribution in the tax year ending 5 April 2021. The annual allowance income limit was increased to £200,000, significantly reducing the number of people affected by the tapered annual allowance. The availability of a full […]

- 1

- 2