With the digital age well and truly upon us, along with the introduction of agile working during the pandemic, more and more employers need to provide their employees with the correct tools to carry out their work. One such tool is that of communication, whether that entails texting a colleague […]

Tag Archives: tax advice durham

Land and property are usually the most expensive assets a person will own throughout their lifetime, whether it is their home, their business premises, or even a holiday getaway in the country. As a result, they often attract the largest tax bills a person might have to pay. These […]

With Christmas fast approaching you may be stuck for ideas of what to get your nearest and dearest. If the idea of spending a day walking around a busy shopping centre fills you with dread, you may want to consider a cash gift instead. But before you go reaching for […]

At the start of the pandemic HMRC introduced several tax concessions to provide additional support to employees working from home but what are the tax implications of these additional perks? In the 2020/21 tax year, as an employee you may have received extra support from your employer to enable […]

You may wish to consider the tax liabilities associated with gifts. Many companies view gifts as an ideal means of promoting their business and boosting morale amongst their workforce. However – as ever – the tax legislation is not as straightforward and it is important to take appropriate advice to […]

With less people holidaying overseas the demand for UK holiday lets has soared. They also seem to have taken on a mythical status in the tax world due to some of the more generous ways that the tax system deals with them. So let’s quickly take a look at some of […]

The entertaining of clients, customers and staff has always been an important part of business strategy. It can help to strengthen and maintain client relationships and improve staff morale and loyalty. But alongside this are important tax considerations. What is entertainment? Essentially, it is hospitality of any kind. This […]

The end of a relationship, particularly divorce is difficult for so many reasons, but you may not realise that divorce and the end of a marriage or civil partnership, could lead to tax complications. Most people know that transfers of assets between married or civil partnered couples are free […]

Capital allowances are one of the most complex areas within UK tax legislation. A lot of the rules originally came from case law until the various decisions were legislated within the Capital Allowances Act of 2001. Broadly speaking, capital allowances are a tax-approved form of depreciation. Whereas accounting principles allow […]

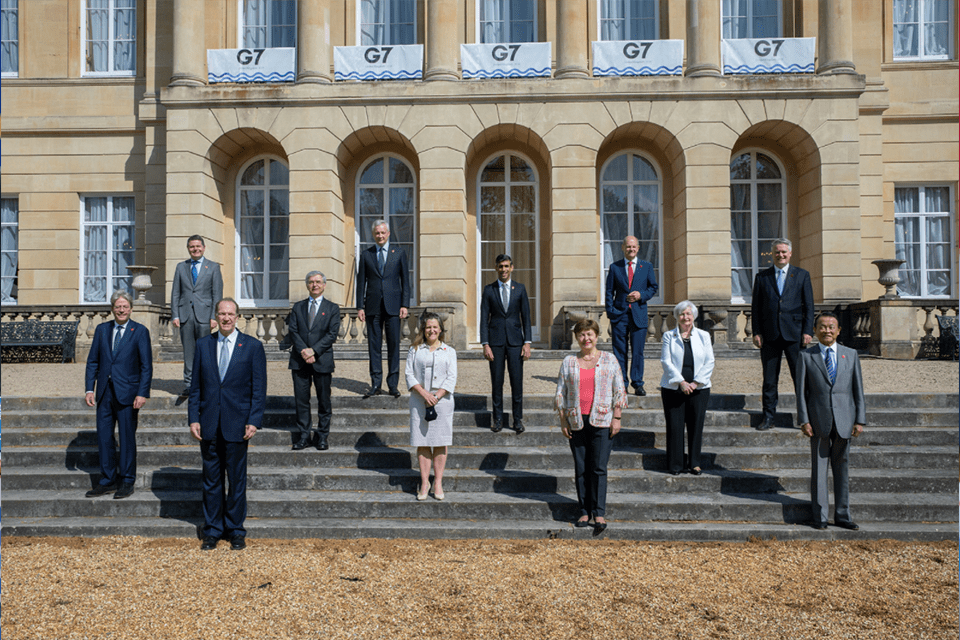

It is no secret that many governments have struggled to tackle the tax challenges that arise from an increasingly globalised and digital economy. However, following years of discussion, on 5 June 2021 G7 agreed to back an historic international agreement on a global tax reform, which will push for […]