Amanda Cowie celebrates 10 years at Robson Laidler Wealth this month working as a Director and Chartered Financial Planner. Here’s some of her highlights from the past decade… You started in June 2012, is life as a financial planner been all that you expected?! Being married to a financial […]

Tag Archives: Robson Laidler Wealth

A very good question a few of our clients have been asking recently is; “Am I invested in Russia?” You may be aware that we provide both our mainstream and ESG (you might call them ethical) portfolios. The former takes a low cost market approach and the latter has been […]

At Robson Laidler Wealth we know a great client relationship is built on transparency and trust and with that in mind we thought we would delve into the lives of our advisers, to find out more about them and their daily routine at work and to help you get to […]

At Robson Laidler, we want you to get to know us better! This month, we ask Robson Laidler Wealth’s Lydia Sutton 10 Questions… What is your role & how long have you done this for? My role is Wealth Administrator I have now been here since May 2021. What […]

At Robson Laidler, we want you to get to know us better! This month, we ask Robson Laidler Wealth’s Jennifer Gilroy 10 Questions… 1. What is your role & how long have you done this for? Wealth Administrator. I started with RL Wealth in May this year joining at an […]

This week Robson Laidler Wealth is supporting CISI Financial Planning Week, and our team are offering free advice on family budgeting, financial goal setting and making the most of your resources. Don’t miss the opportunity to book a free financial planning session (up to 45 mins) either online via […]

We know that people are our most important asset and that our clients enjoy getting to know more about the real people behind Robson Laidler Wealth. So, here is our series of ‘Getting to Know You’ where we focus on a different staff member each month and ask them 10 […]

Robson Laidler Wealth is moving forward with a senior financial planning promotion and a raft of new appointments as it continues to grow. The financial planning firm has seen a 14% increase in turnover in its last financial year and is set to growth by a further 10% this […]

The end of a relationship, particularly divorce is difficult for so many reasons, but you may not realise that divorce and the end of a marriage or civil partnership, could lead to tax complications. Most people know that transfers of assets between married or civil partnered couples are free […]

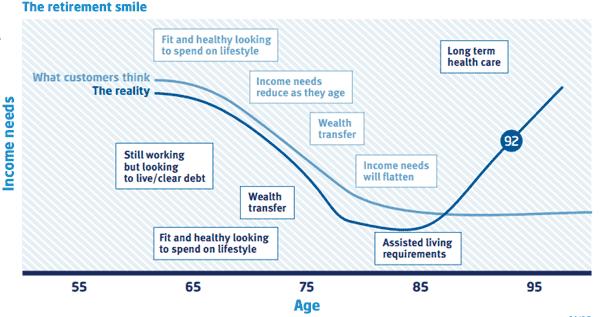

Financial planning – Why it’s better for your money to outlive you? When we put together a financial plan, we use a mortality of age 100 because we don’t want you to run out of money. We also use a financial planning forecasting tool to help you “see” your financial […]

- 1

- 2