Minimise Your Tax Bill with Allowable Business Expenses Allowable Expenses is a term used to describe costs or expenses you incur while running your business that you can claim as tax deductions therefore reducing the amount of tax you pay on your profits. However what expenses you can claim […]

Tag Archives: Tax Relief

Repairs and Renewals A distinction is drawn between repairs and improvements when considering if tax relief is available. The general rules are that: Expenditure on restoring an asset to its original state is revenue in nature and so allowable in calculating taxable trading profits; and Expenditure […]

At the start of the pandemic HMRC introduced several tax concessions to provide additional support to employees working from home but what are the tax implications of these additional perks? In the 2020/21 tax year, as an employee you may have received extra support from your employer to enable […]

Not many businesses operate without a bit of bad debt, although hopefully it is just the odd one! However, for tax purposes, there are different rules depending on the tax involved. VAT Relief On Bad Debts There are detailed instructions for VAT relief on bad debts which is set out […]

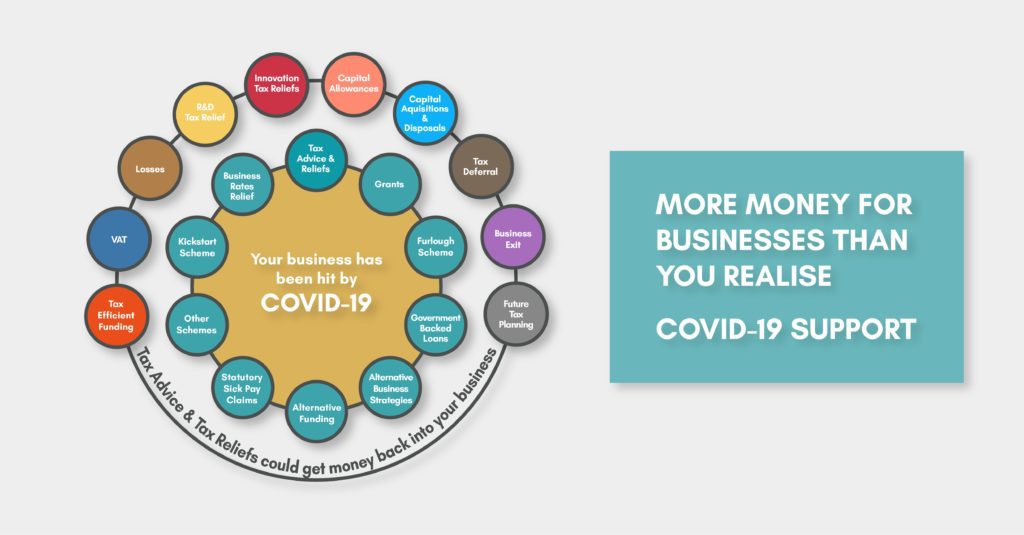

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

Back in July 2015 the then Chancellor, George Osborne, announced a change to the way that tax relief for finance charges, in particular loan and mortgage interest, would be given against residential property rents. Rather than reducing the net profit of the residential property business, any tax due would be […]

You may be able to claim tax relief for additional household costs if you have had to work at home on a regular basis, this includes if you have to work from home because of coronavirus (COVID-19), either for all or part of the week. Additional costs include things like heating, metered […]

R&D tax relief for SMEs is so generous that it is considered to be a Notified State Aid by the European Commission. The problem is that much of the financial support brought in by the Government for businesses during the Coronavirus pandemic is also considered to be Notified State […]

ROBSON Laidler has launched a service that has already saved our clients almost £395,000 by realising and reclaiming Research and Development (R&D) tax credits available to them from HMRC. We have established the new R&D tax credits offering to complement our accounting, business advisory and wealth management services, to help […]

With tax year end just around the corner, it’s time to check you are making the most of your tax reliefs and allowances to save for a brighter future. You may want to consider High earners: making a pension contribution before the tax year end could increase your annual allowance […]

- 1

- 2