Structures and Buildings Allowance This change, announced at Budget 2018, provides for capital allowances for expenditure incurred on or after 29 October 2018 on the construction of a building or structure in qualifying use. The annual rate of allowance is 2%. After some delay HMRC have now published the draft […]

Author Archives: RobsonLaidler

Traditionally GP and dental practices have only really looked at their financial performance as and when the year-end accounts have been delivered, prioritising (and rightly so) the care of their patients. However, practices have faced increased pressure in recent years, and as such, the need to keep on top of […]

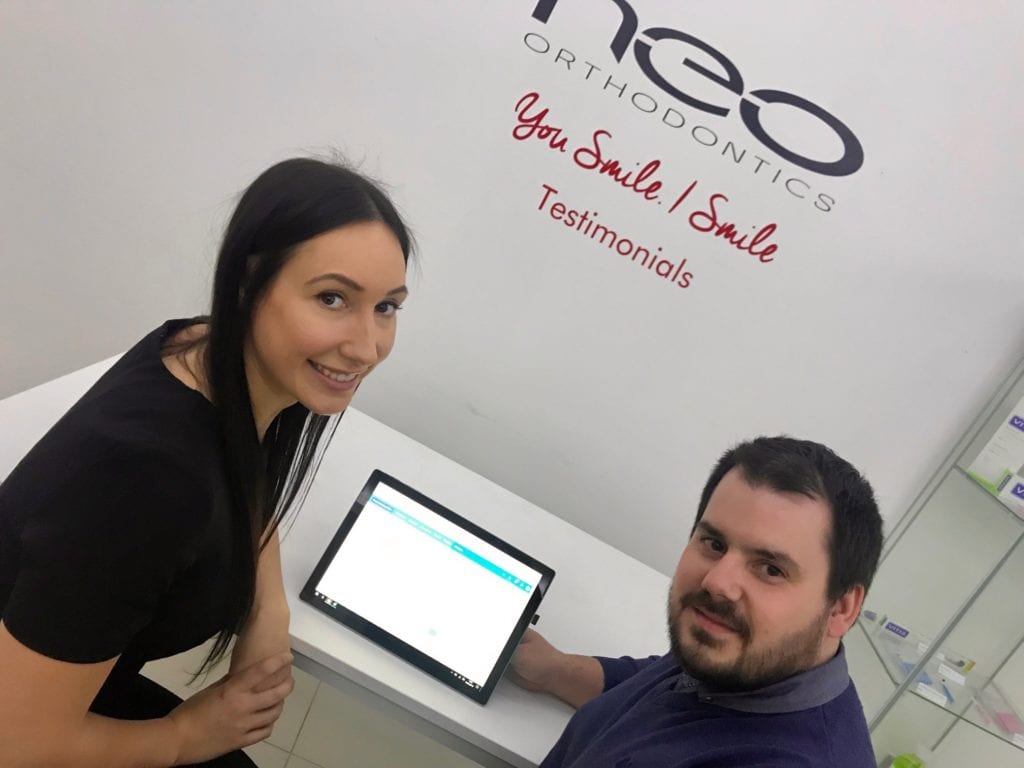

Our healthcare team has managed to revolutionise its client base by placing all dental associates on digital software. As part of a major technological shift in the way accounts need to be filed to HMRC, better known as Making Tax Digital, Robson Laidler Accountants has achieved 100% success two years […]

HMRC has published a letter to UK businesses that trade only with the EU, with details of important actions they need to take and changes to be aware of in the event of the UK leaving the EU without a deal. This is the third letter to businesses on preparing […]

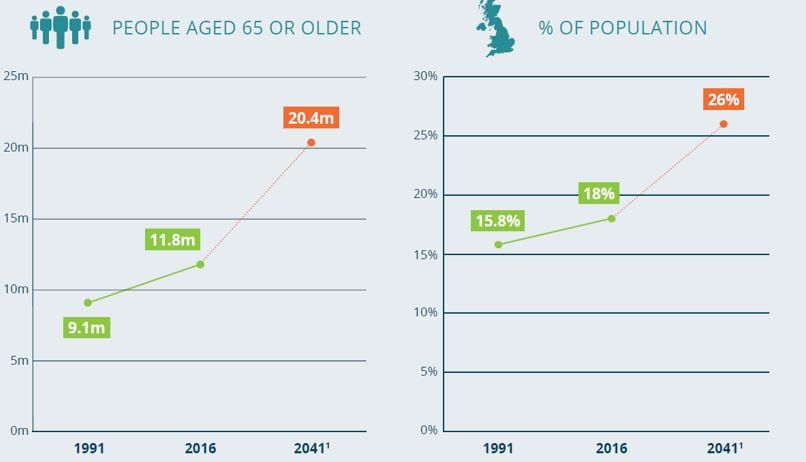

As a recent report from the Office of National Statistics highlights that we are living much longer than previous generations, it is becoming increasingly more important to get later life planning in place. The fastest growing age group is those aged 85 or over and this is expected to double over […]

Robson Laidler Wealth are here to support you in your lifestyle goals and objectives. We’re all quite good at planning for the short term, but what about the long term? Robson Laidler Wealth are here to help you answer the question; “Will I be financially OK in the future?” Our new video showcases […]

How to build credibility in your business? When you watch a movie, you can almost believe anything on-screen, because it’s not real life, it’s fantasy. The skills of the characters in the movie, ‘The Incredibles’ for example – we know that people cannot lift cars, move faster than a speeding […]

It is now six months until Making Tax Digital (MTD) kicks in. So here at Robson Laidler Accountants we are ready to guide you. WHAT IS MTD? MTD is a government initiative to bring the tax system online. It means linking business accounts through to HMRC’s systems in an automatic […]

Xero…what makes it great? (Short version) Everything! (Extended version) It starts right back from the founder and his vision to make a platform to allow ‘beautiful business’. The motive is quite simple, it helps you take control of the numbers, so you can focus on what you do best. It […]

Invoicing customers and getting paid on time is a vital part of any business and it is essential that this is done effectively, efficiently and economically. This important element of your business is perfectly covered by the Cloud software package Xero, here’s how they do it… The first benefit of […]