Here at Robson Laidler Wealth our team of Chartered Financial Planners can support solicitors with their court appointed deputy clients in having those difficult conversations around setting budgets. In our experience, when someone receives an award of this level, it can make them or their family feel like they’re millionaires, […]

Tag Archives: financial planning north east

In 2019 Robson Laidler Wealth wrote a blog entitled NHS Pensions – handy hints to plan your exit This has been one of our team’s most viewed blogs yet since 2019 there have been a few changes, which you should be aware of. One thing that hasn’t changed and […]

The pandemic over the past 20 months has taken its toll in different ways. For many this has included relationship breakdowns and sadly we have seen a rise in divorce and separation with our own clients. We’ve also spoken to some highly regarded North East solicitors who specialise in […]

Whether you are a busy professional, medic or business owner, the simple answer to the question, “when should I start planning my retirement?” is – now! It’s never too early. If you organise your life now you will minimise stress for yourself and your family in future. Holiday season […]

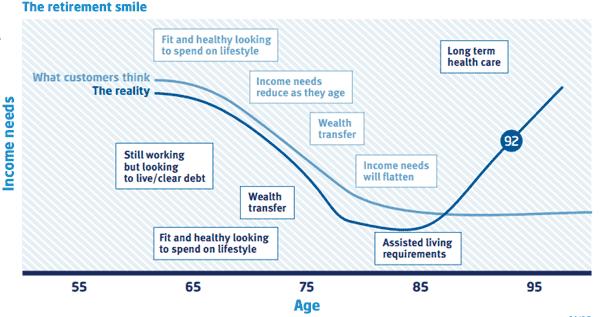

Financial planning – Why it’s better for your money to outlive you? When we put together a financial plan, we use a mortality of age 100 because we don’t want you to run out of money. We also use a financial planning forecasting tool to help you “see” your financial […]

Peace of mind is a phrase that’s used a lot, particularly by financial organisations. Here at Robson Laidler Wealth we would say that it’s about understanding where you are, where you want to get to and how to get there. Inevitably, this gives you confidence about the future, and that’s […]

I was having coffee with friends, in those pre-lockdown halcyon days, and one asked “when do you think you will retire?” My answer is always the same “when my pension and investments reach the magic number!” Obviously my magic number is personal! But I 100% know what it is and […]

The coronavirus pandemic has been a wake-up call for many of us in various senses, but especially when it comes to finances. That’s why the theme of this year’s Good Money Week is ‘Clean Slate Green Slate’, encouraging people to consider green investment options, particularly as nearly 40% of us […]

Today to support Financial Planning Week are some top tips from our paraplanner Danielle Knowles for young families saving for their future whilst looking after their loved ones… I am Danielle, a 37-year-old mum of two to Charlie 5 and Daisy 3. Working in financial services makes you […]

Our sister company Robson Laidler Accountants and Tax Advisers have scheduled a Webinar Wednesday 9 September on “Cashflow Management”. This event is for business owners and you can contact ggraham@robson-laidler.co.uk if you would like to attend. But what about our own, personal cash reserves? Whilst the last 6 months have […]