The Government has today (15.07.20) temporarily reduced the VAT rate to 5% (from 20%) in order to support the hospitality sector on certain good or services. This reduction will apply to food and non-alcoholic drinks supplied by restaurants, pubs, bars, cafes and to hot take-away food outlets. The reduced rate […]

Tag Archives: Tax Advice

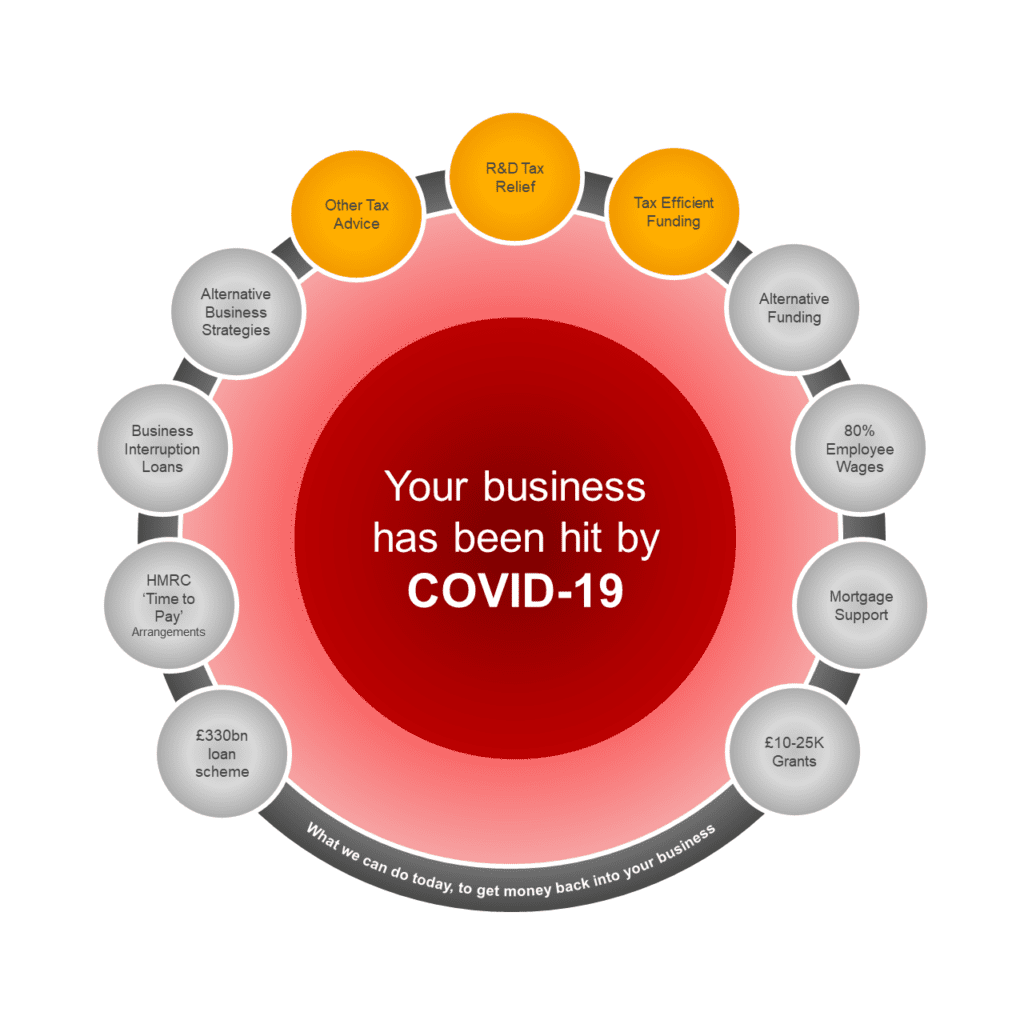

As the pandemic continues to grow in the UK, businesses are currently faced with extremely difficult conditions and for most companies, business as usual is not an option. Due to the rapid spread of the virus and enforced lockdowns, for many, sales are minimal to negligible and businesses are being hit […]

ROBSON Laidler has launched a service that has already saved our clients almost £395,000 by realising and reclaiming Research and Development (R&D) tax credits available to them from HMRC. We have established the new R&D tax credits offering to complement our accounting, business advisory and wealth management services, to help […]

“An Englishman’s home is his castle,” or so goes the oft-quoted adage…But what happens if you receive an unexpected Let Property Campaign letter from HMRC which states you may have underpaid tax? For many people a buoyant property market is the principal barometer of the health of the economy and […]

INTRODUCTION Brexit has becoming synonymous with the word uncertainty. Indeed, the events of the previous week that have blown the plan to deliver Brexit by the 31 October out of the water have perfectly encapsulated this sentiment. Parliamentary debates about backstops and no deals and everything in-between have left all […]

In recent months HMRC has issued a flurry of Requirement to Correct (RTC) letters urging individuals to disclose their worldwide income and gains and ultimately aims to recover unpaid tax. But what do these letters mean? Our world is becoming ever smaller and interconnected. Whether it be a 10am Skype […]