A common issue in business occurs when business owners don’t fully understand how profit their business is generating. The Importance of understanding profitability: Financing – Understanding business profitability is important as profits influence financing decisions such as obtaining loans from banks. Dividends– Profitability is also important when extracting dividends […]

Author Archives: RobsonLaidler

The entertaining of clients, customers and staff has always been an important part of business strategy. It can help to strengthen and maintain client relationships and improve staff morale and loyalty. But alongside this are important tax considerations. What is entertainment? Essentially, it is hospitality of any kind. This […]

Time management in running a business can often feel like this: stop, start, stop, start, think, start, stop. You don’t have the time or resources to gain full momentum most of the time and when you do, there’s always something niggling away at you that needs to be sorted. This […]

We’ve met lots of business owners recently who are still working hard well into their 60’s. This is typically because they love what they do. But also it’s because they haven’t had a chance to consider making plans. They are too busy! So, why should you take your foot […]

It is being reported that there are an increasing number of people being ‘pinged’ by the NHS COVID-19 App. The terminology ‘pinged’ is referring to when a person is sent an alert by the App. The App sends anonymous alerts if the user has been in close contact with another […]

As a business owner do you find you are wearing too many hats? If so you may need to run an organisational review on your business. In order for a business to run effectively and efficiently there needs to be a clear organisation chart, which visually defines departments, functions, roles […]

Legal restrictions in place in respect of Covid-19 start to end today (Monday 19th July) in England, Wales and Scotland. Each country is taking a slightly different approach to timings and some of the detail around what is required, but in all countries, there is the start of an easing. […]

What efficiencies should you have in place to make going on holiday easier when you are a business owner? Everyone loves to go on holiday whether it’s a staycation or visiting foreign shores and it is important for your health and mental wellbeing to have time off work. Taking a […]

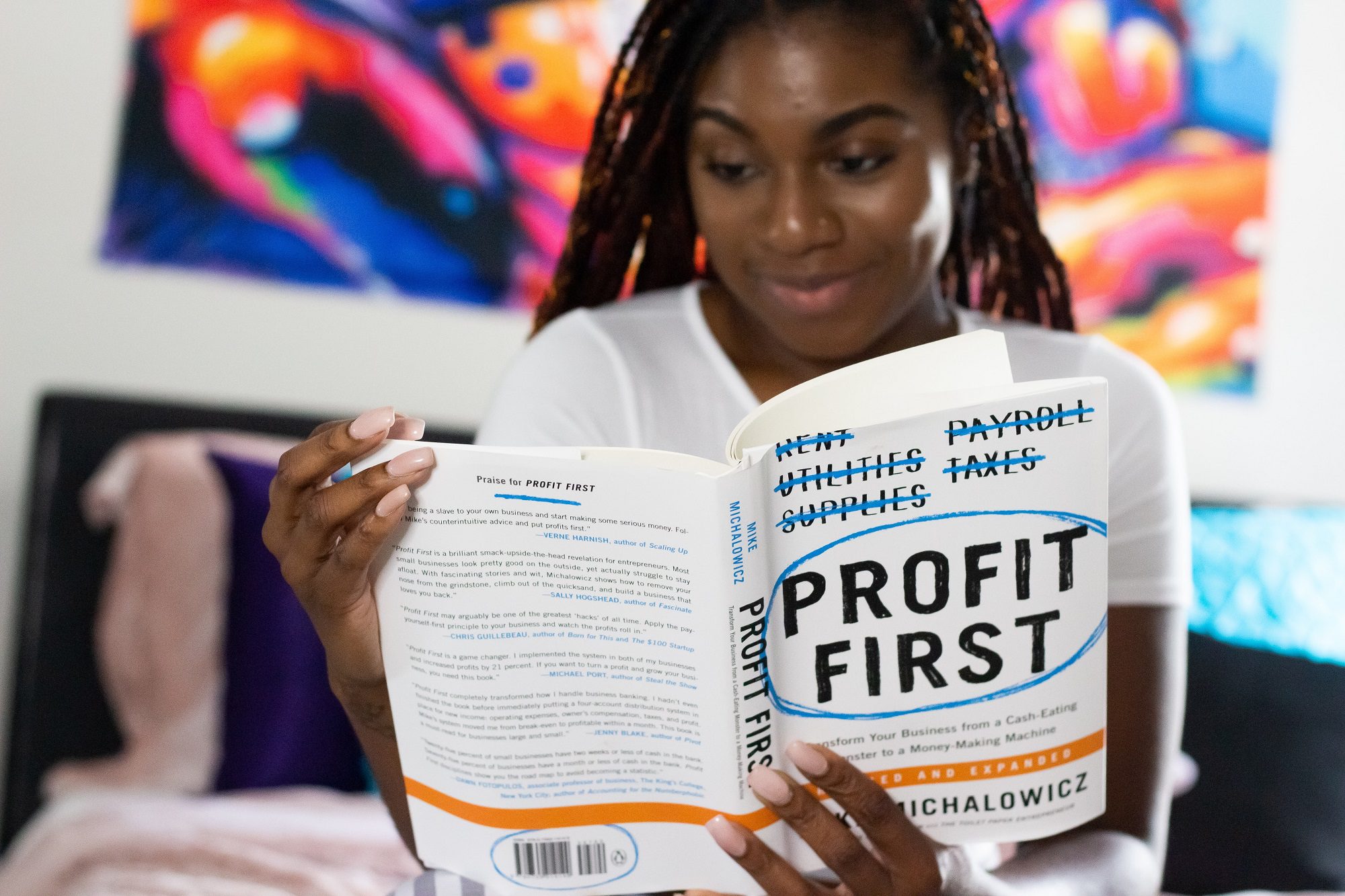

One of the most stress-inducing parts of running a business is not knowing enough about your cash. How much is coming in, how much is going out, where it’s going, whether you’re covered. No fear hits quite like an unexpected bill when you’ve got a bunch of overheads that need […]

What do these new VAT rules mean for UK sellers? From 1 July 2021, the VAT rules on cross border sales from business to consumer (B2C) have changed. A consumer being an individual or organisation that is not registered for vat. There is no longer a threshold for distance selling […]