There is a general impression, both in mainstream media and, more importantly, within HMRC, that up to 10% of claims for CJRS may be “inaccurate.” HMRC has announced that it will be enquiring into claims and it anticipates that about 25% of all claims will be looked into. Whilst we […]

Author Archives: RobsonLaidler

Think back to the 80’s (if you can!) we had Wall Street, Harry Enfield’s Loadsamoney, Miami Vice, regular news items on city traders making a fortune. At that time being a millionaire was out of reach for most people. Maybe a bit distasteful even. Since then, due to the success […]

As a healthcare professional, how many times have you purchased a work-related expense and not claimed for it? Are you confident you are maximising your income by claiming all tax-deductible expenses that you have incurred as part of your job? Are you sure that your tax responsibilities are being fully […]

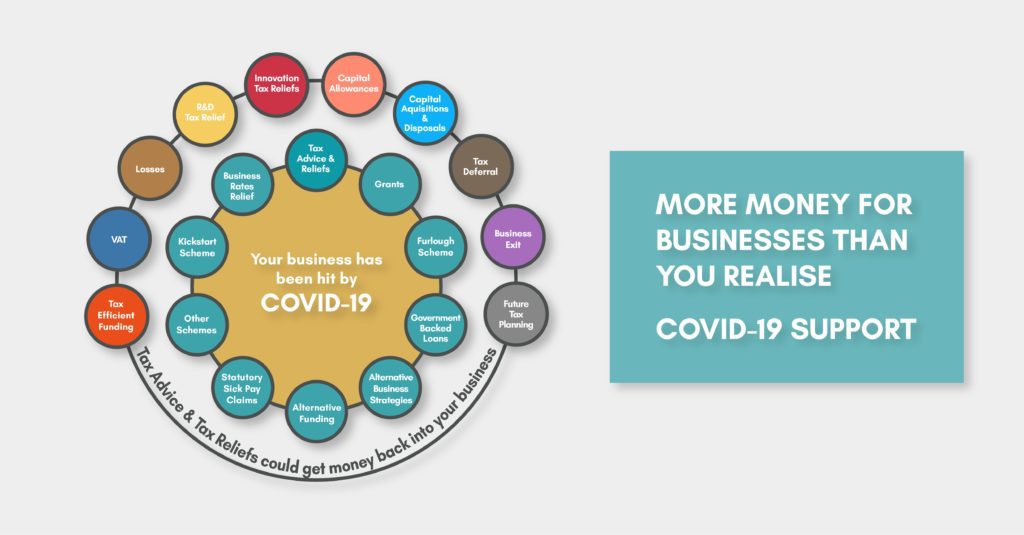

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

What does it mean to me and my people? With most journeys you take you are likely to check a map. A map helps you understand the route you need to take to get to your destination – or goal. Motivation is energy; it is what fuels us to take […]

Back in July 2015 the then Chancellor, George Osborne, announced a change to the way that tax relief for finance charges, in particular loan and mortgage interest, would be given against residential property rents. Rather than reducing the net profit of the residential property business, any tax due would be […]

In a recent global study* the question “What do you value in the relationship you have with your financial adviser?” The results were: Given what we are going through at the moment you might say that this is pretty obvious. However these results were similar pre-pandemic. So, how do you […]

Many policyholders will have been celebrating after the Supreme Court ruling on insurance contract wordings went substantially in their favour. While this may offer hope to SME’s, the ruling may not be the solution for all situations for a number of reasons: Policies have slightly different wordings and only a […]

Everyday it seems I’m getting queries from clients asking whether they can buy individual shares through the investment accounts that we manage. These queries are likely to be generated as a result of the sizeable gains seen in some stock prices since last March after the pandemic effects took […]

We are deeply concerned about the plight of the smaller businesses across the UK including the c. 3m self-employed directors of limited companies, who are not eligible for the government’s existing grants, and have therefore been excluded from the financial support measures during COVID-19. self-employed director And this is one […]