If your offspring are flying the nest next month to university you’ve probably got mixed feelings. You may feel happy for them but wondering if you’ll feel bereft/glad that you won’t be getting woken up at 3am when they come home from the nightclub. You’ve probably also done most […]

Category Archives: Blog

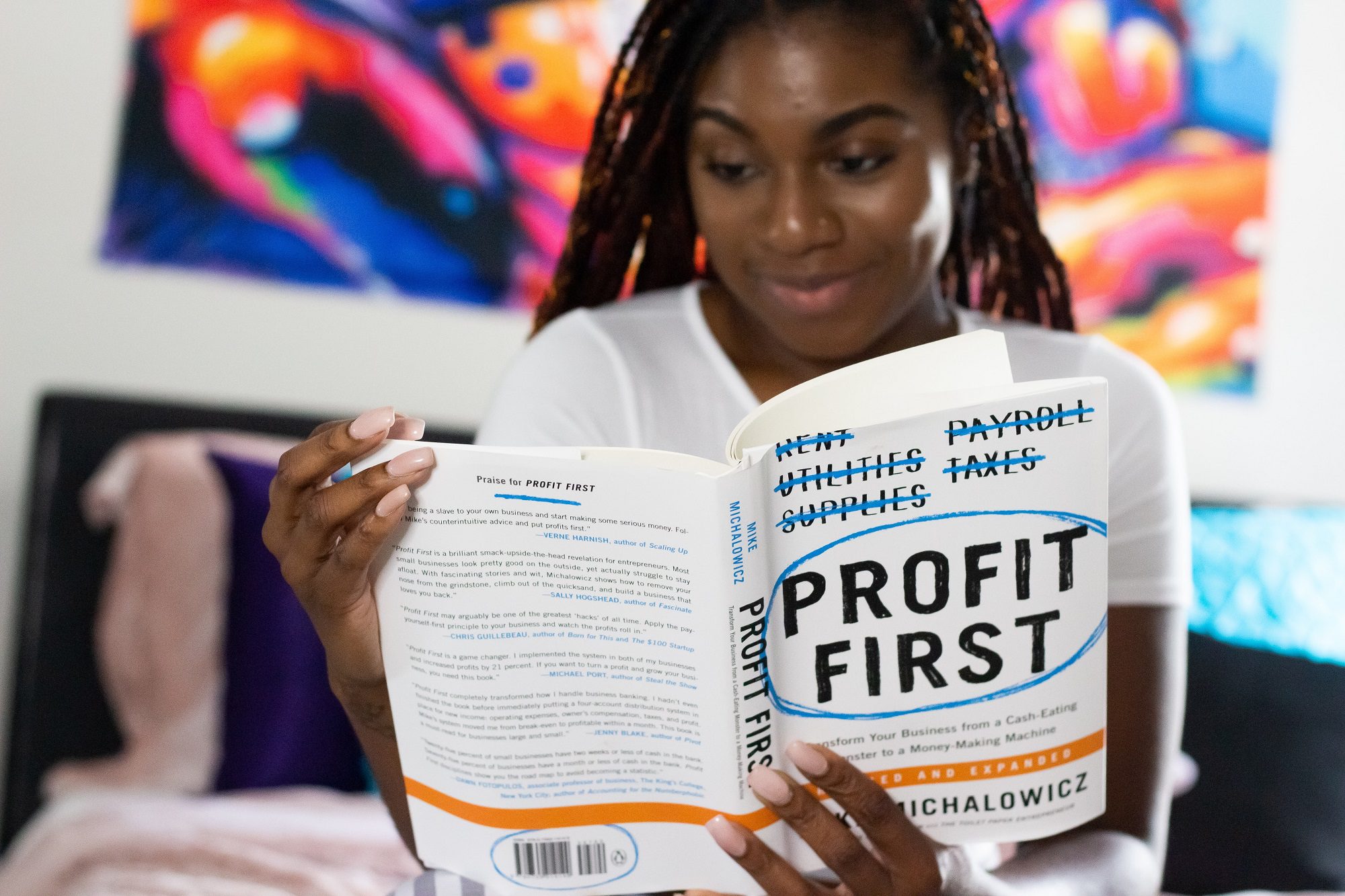

When you are running a business it’s easy to confuse cashflow with profit. After all both could be considered to indicate that you’re making money, so what exactly is the difference between the two? Profit Profit looks at the total financial gain (or loss) that a business experiences over a […]

Robson Laidler Wealth is moving forward with a senior financial planning promotion and a raft of new appointments as it continues to grow. The financial planning firm has seen a 14% increase in turnover in its last financial year and is set to growth by a further 10% this […]

To those of you in the hospitality and tourism sector, you have been enjoying a reduced rate of VAT (5%) since 12 July 2020. This reduced rate applies to most supplies made by hotels, tourist attractions, members’ clubs and most places that host events. It also applies to the food […]

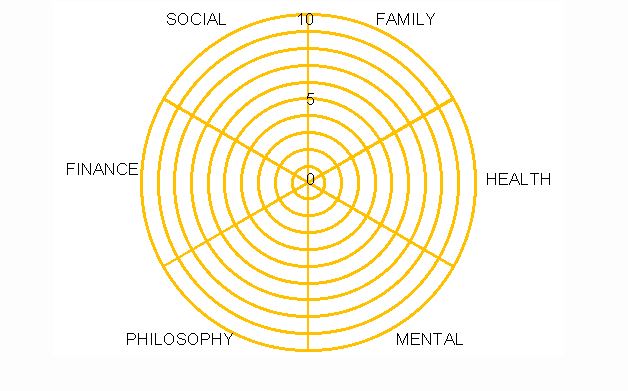

Work – life balance – work to live or live to work? It’s an increasingly hot topic of late as working from home, flexible and agile working becomes more the norm. Many would think this would facilitate a balance; however, some people still find that when they are at home […]

With less people holidaying overseas the demand for UK holiday lets has soared. They also seem to have taken on a mythical status in the tax world due to some of the more generous ways that the tax system deals with them. So let’s quickly take a look at some of […]

There is an increasing amount of damage caused by fraud in the business world. It is easy to perceive this as a risk that just affects larger organisations or that it simply ‘won’t happen to a business’ like ours. These assumptions are dangerous and can post great risk if adequate […]

We are proud to announce that Robson Laidler is officially the first business in the North East to receive certification as a B Corporation (B Corp). We have joined 4000 businesses globally and 400 in the UK who have certified as B Corps reinventing business by pursuing purpose as well […]

The landscape of Research and Development tax incentives has changed significantly over recent times, with HMRC recommitting itself to reducing the loss in tax revenues due to fraudulent or erroneous claims (currently estimated at around £311m per year by the National Audit Office). HMRC has already taken steps to reduce […]

A common issue in business occurs when business owners don’t fully understand how profit their business is generating. The Importance of understanding profitability: Financing – Understanding business profitability is important as profits influence financing decisions such as obtaining loans from banks. Dividends– Profitability is also important when extracting dividends […]